Step by Step Guide to Claim ITC by Form ITC-01

Form ITC-01

GST Form ITC-01 is a declaration form that is used to claim the ITC after getting GST registration. A taxpayers require to furnish invoice wise details of ITC in Form ITC-01 before last date for file form ITC-01. If the taxpayers claim ITC more than INR 2 lakhs in Form ITC-01, then he require to upload Chartered Accountant certificate or Cost Accountant certificate along with Form ITC-01However a person has to obtain GST registration in order to claim Input Tax Credit (ITC) on stock of inputs, capital goods and finished goods. ITC cannot be claimed before the date of obtaining GST registration. So therefore a taxpayers can claim ITC on stock of goods by using Form ITC-01 only after GST registration.

In following case, Form ITC-01 will use

- Section 18(1)(a):- Form ITC-01 file when any person apply for GST registration is made within 30 days of becoming liable to pay GST.

- Section 18(1)(b):- Form ITC-01 file when any person opts for voluntary GST registration.

- Section 18(1)(c):- Form ITC-01 file when any person opts out of composition scheme but continues to be registered as a regular taxpayer.

- Section 18(1)(d):- Form ITC-01 file when an exempt supply of goods/services becomes taxable supply.

Cut-off dates for claiming ITC

| Section in which Form ITC-01 will file- | Last date for file Form ITC-01 |

| Section 18(1)(a):- Form ITC-01 file when any person apply for GST registration is made within 30 days of becoming liable to pay GST | Last date for file Form ITC-01 is the date immediately preceding the date when he becomes liable to pay tax. |

| Section 18(1)(b):- Form ITC-01 file when any person opts for voluntary GST registration | Last date for file Form ITC-01 is the date immediately preceding grant of registration |

| Section 18(1)(c):- Form ITC-01 file when any person opts out of composition scheme but continues to be registered as a regular taxpayer | Last date for file Form ITC-01 is the date immediately preceding day when he opts to pay tax under regular mode. |

| Section 18(1)(d):- Form ITC-01 file when an exempt supply of goods/services becomes taxable supply | Last date for file Form ITC-01 is the date immediately preceding the date when the supply becomes a taxable supply |

Steps for file Form ITC-01

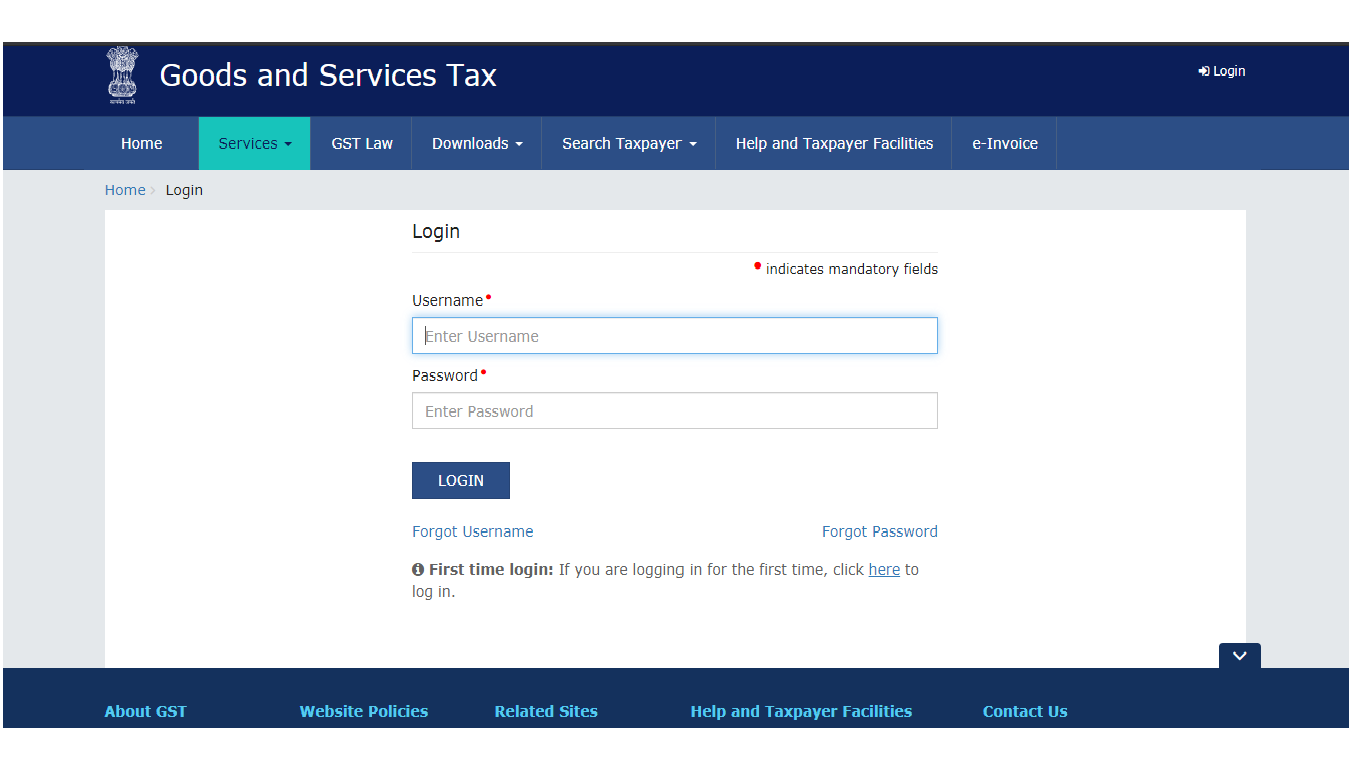

Step 1. Access the www.gst.gov.in URL and login to the GST Portal with valid credentials.

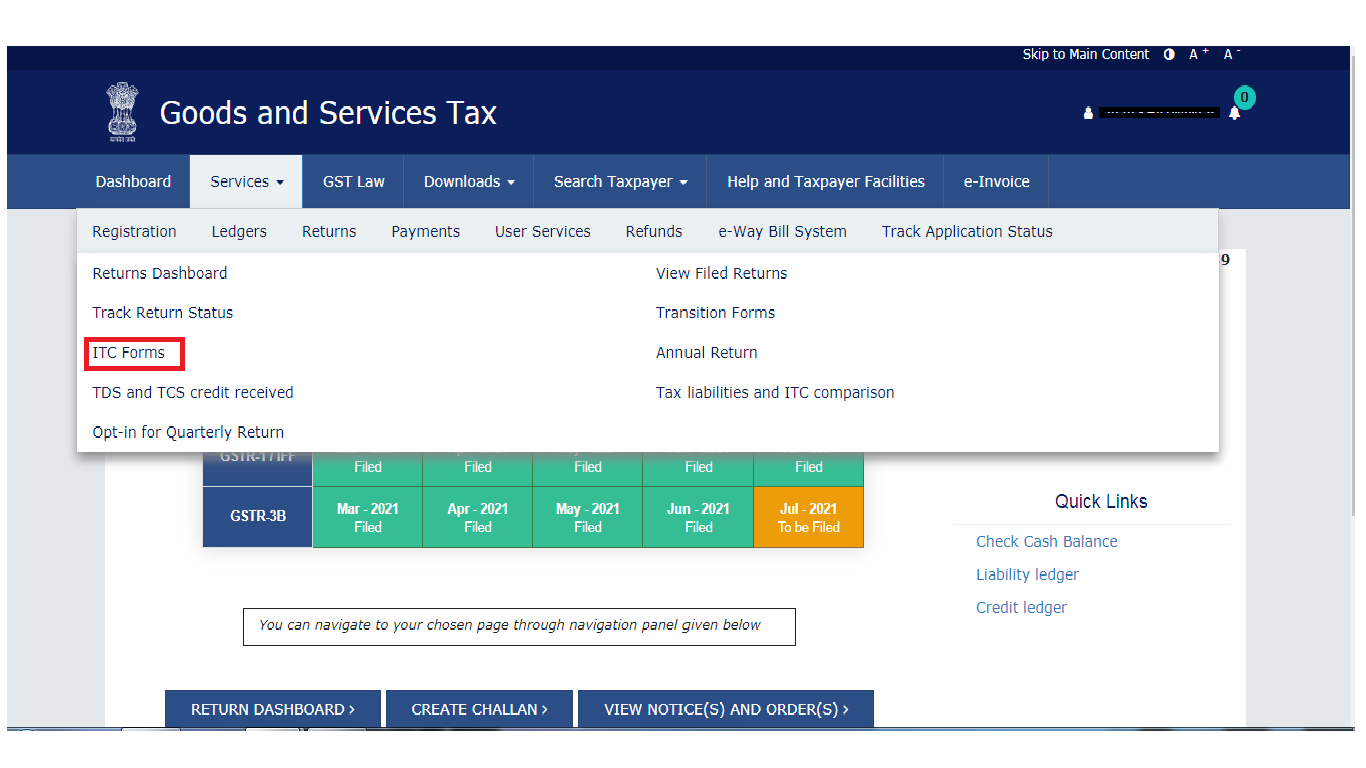

Step 2. Select "Services" tab>> select "Returns" and then click on "ITC Forms". The GST ITC-01 Forms page will display on the screen.

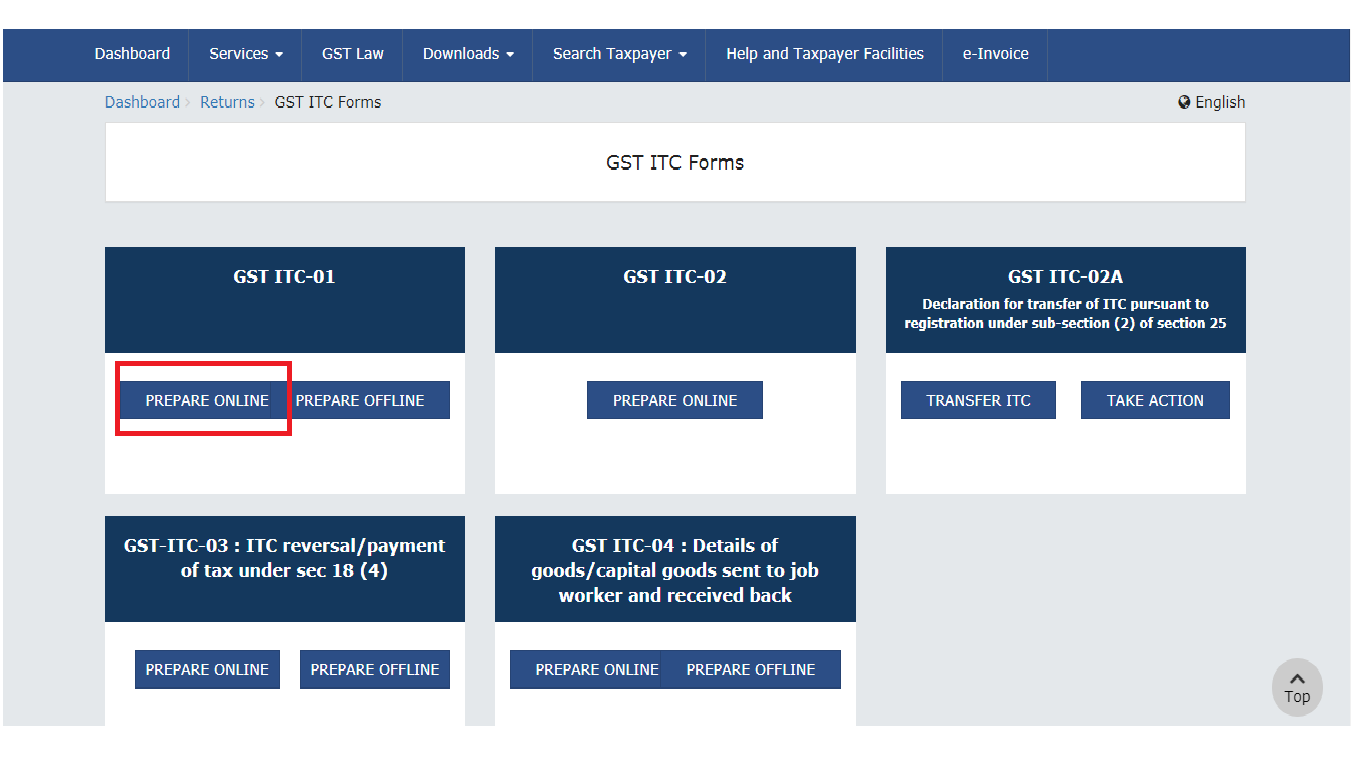

Step 3. Select "Prepare Online" button in Form ITC-01, if the taxpayer desires to provide online details by making entries on the GST Portal in Form ITC-01.

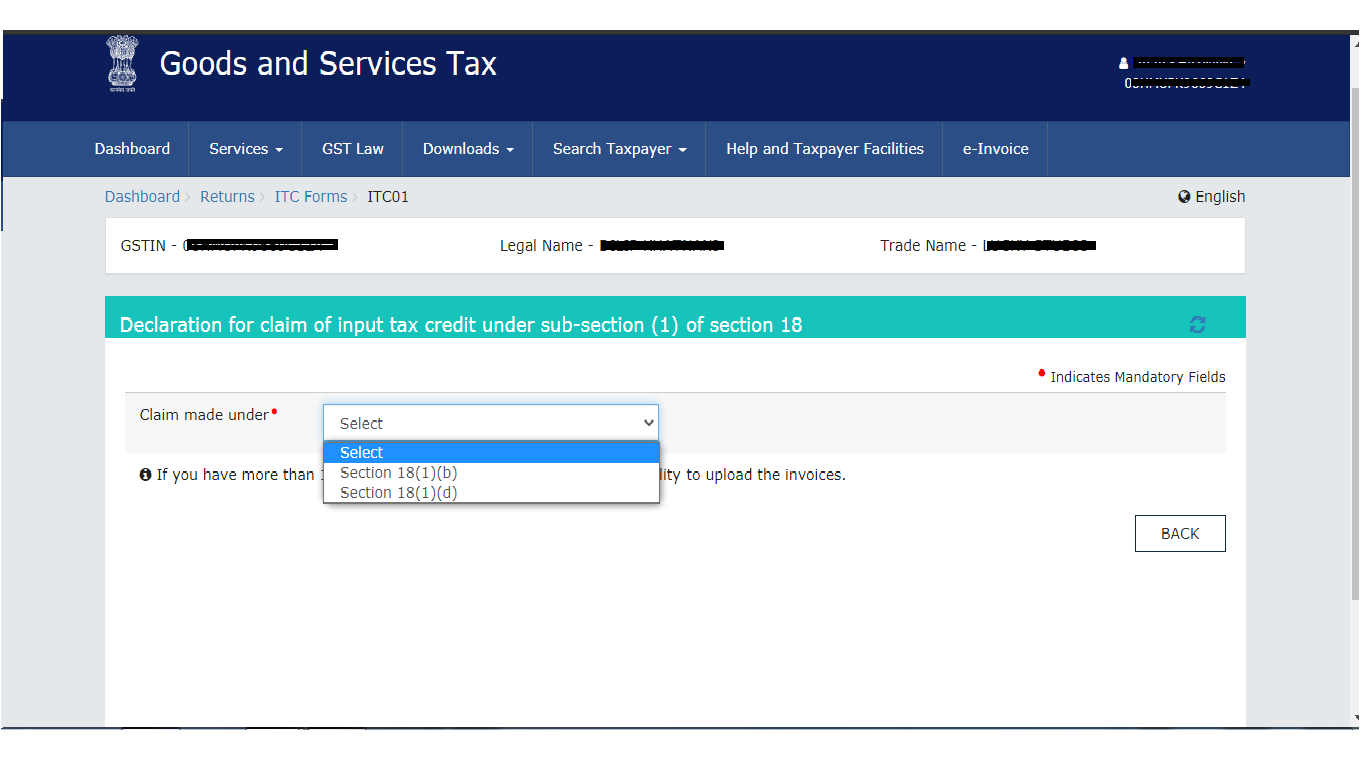

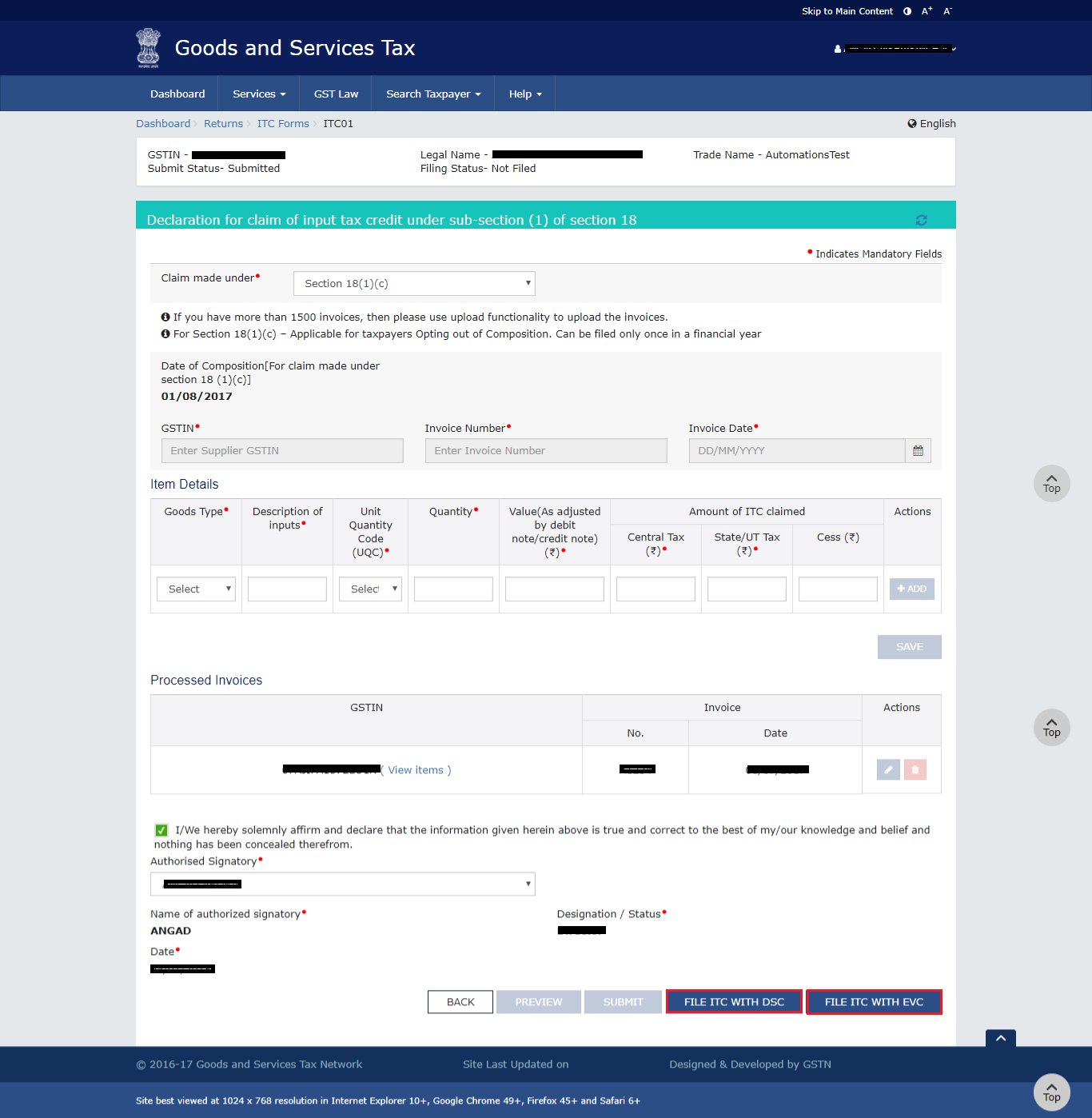

Step 4. Select the appropriate section from the Claim made under drop-down list in Form ITC-01

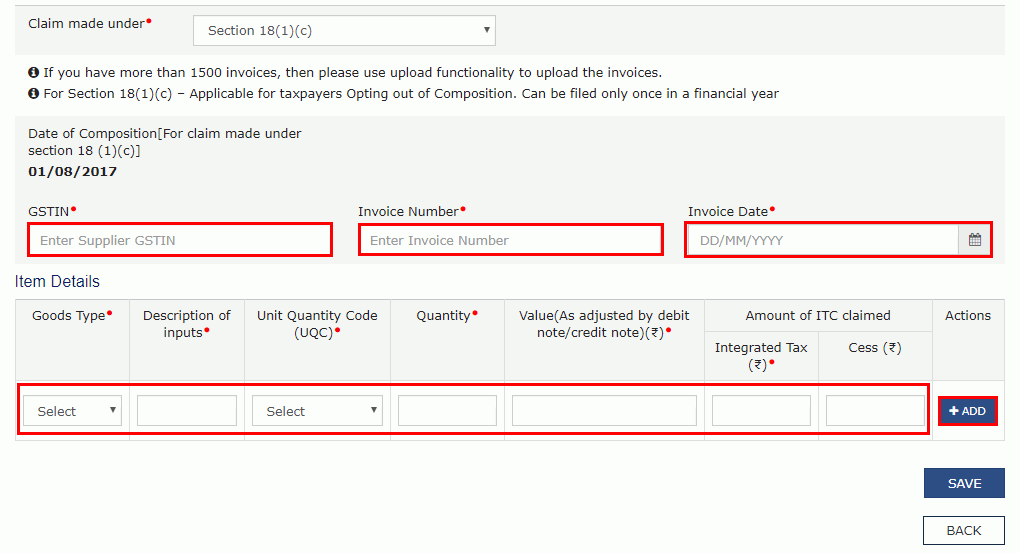

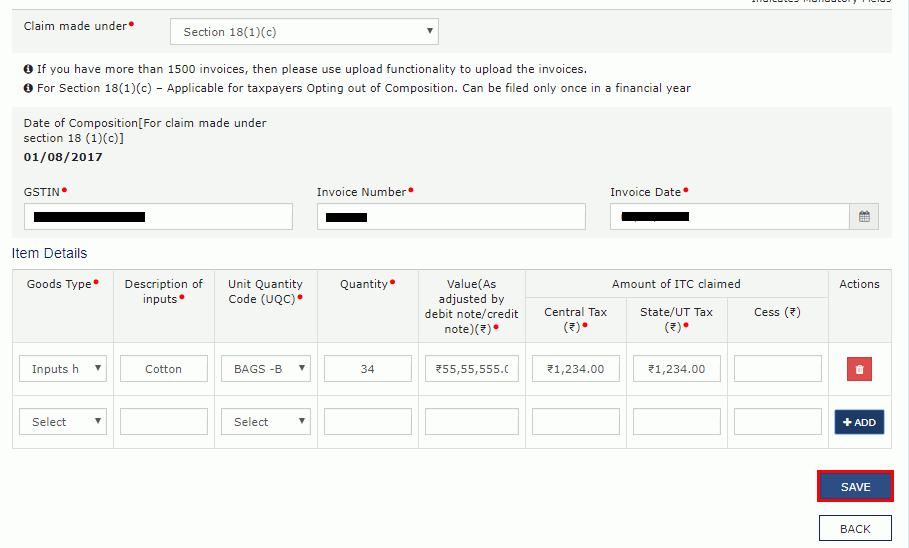

Step 5. Enter invoice-wise details as require in Form ITC-01 and then Click on "Add" button to continue adding more invoices or Click on ‘Save button’ to proceed for submit.

(a)Select the type of goods. (i) Inputs held in stock, (ii) Inputs contained in semi-finished goods or finished goods, (iii) Capital goods.

(b) Enter GSTIN of supplier

(c) Enter invoice number and date

(d) Select Unit Quantity Code

(e) Description of goods -Inputs Enter quantity Enter invoice value

(f) Enter ITC amount

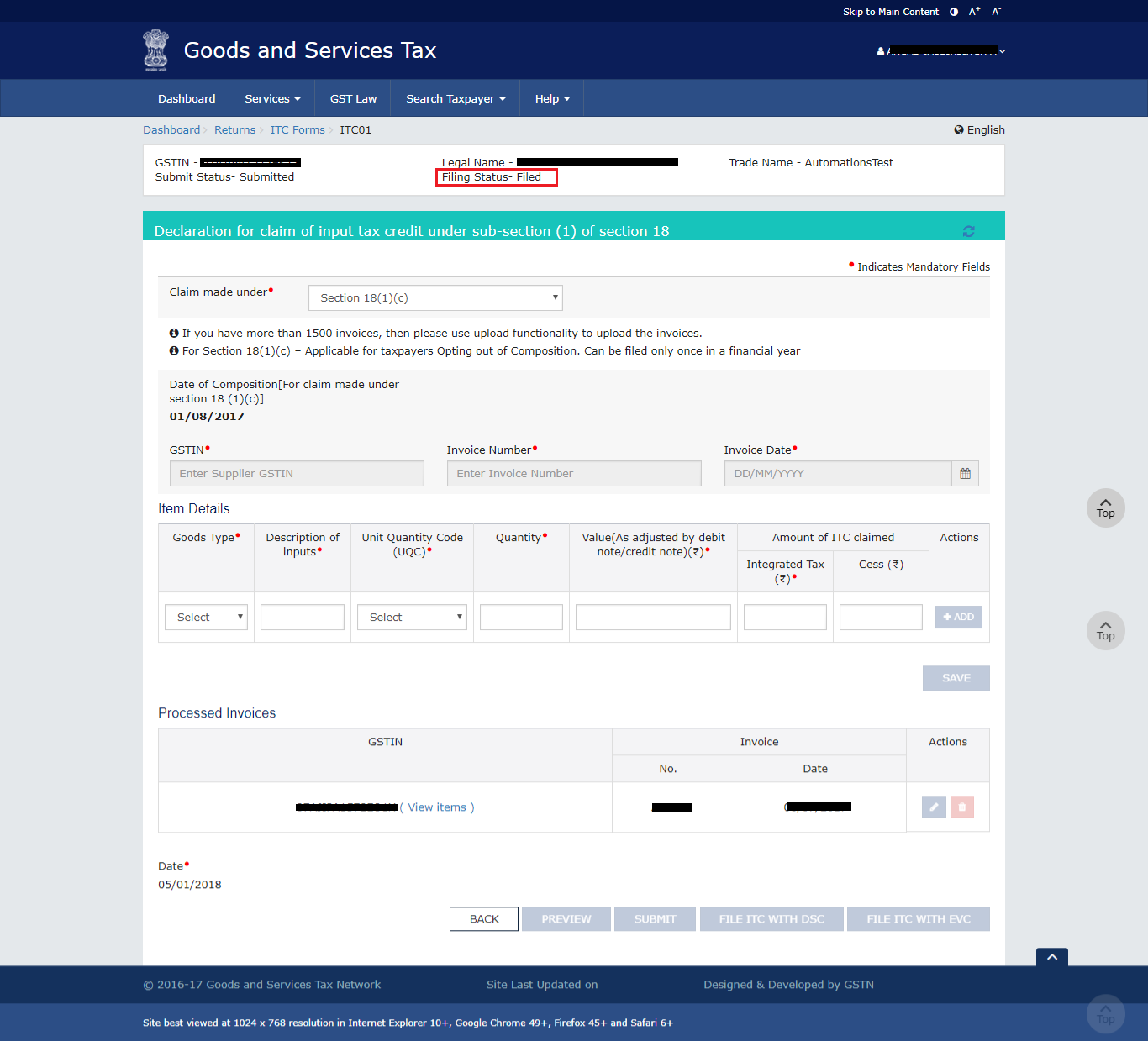

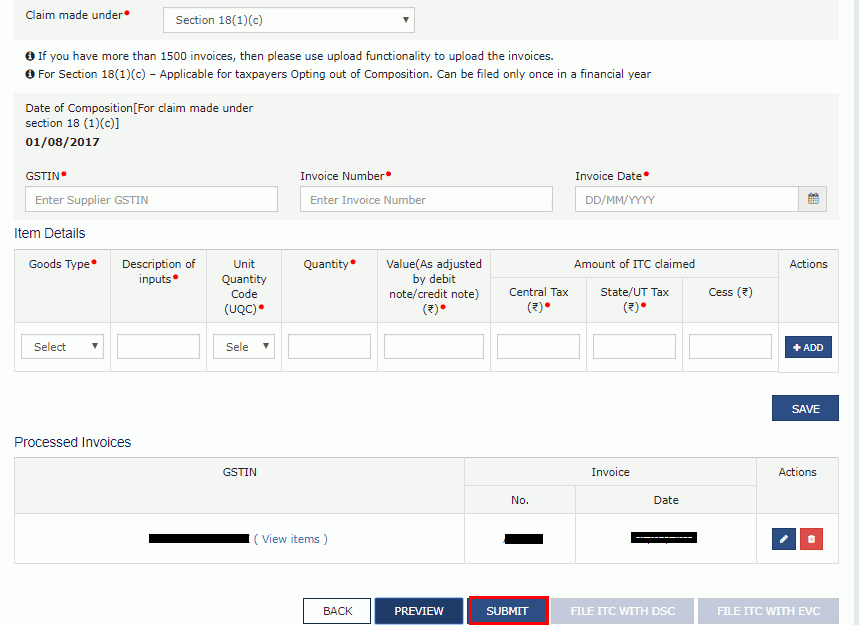

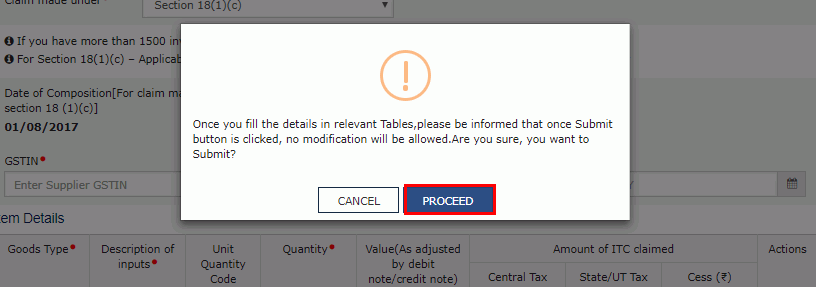

Step 6. After entering all invoices, click Preview > Submit > Proceed. No modification will allow after Form ITC-01 submitted.

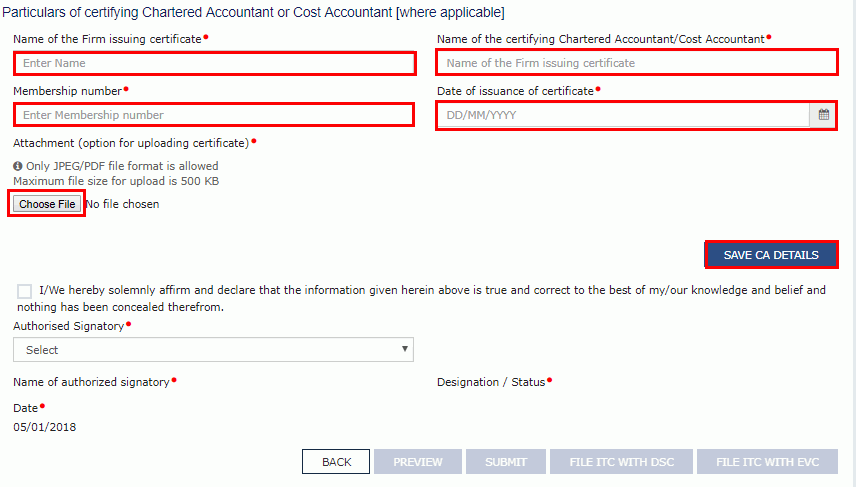

Step 7. Upload CA certificate along with Form ITC-01, if applicable. For claims of more than INR 2 lakhs of ITC, the details of Chartered Accountant or Cost Accountant need to be updated along with the certificate in Form ITC-01.

Step 8. File the form ITC-01 using DSC or EVC after the form ITC-01 is successfully submitted. Click on "File using DSC" or "File using EVC" button and select the authorized signatory from the drop-down list to file using DSC or EVC.

Step 9. Once Form ITC-01 filed, ARN is generated and sent to the taxpayer via SMS or Email. The status of Form ITC-01 is changed to "Filed".