Unblocking of E-Way Bill Generation Facility online

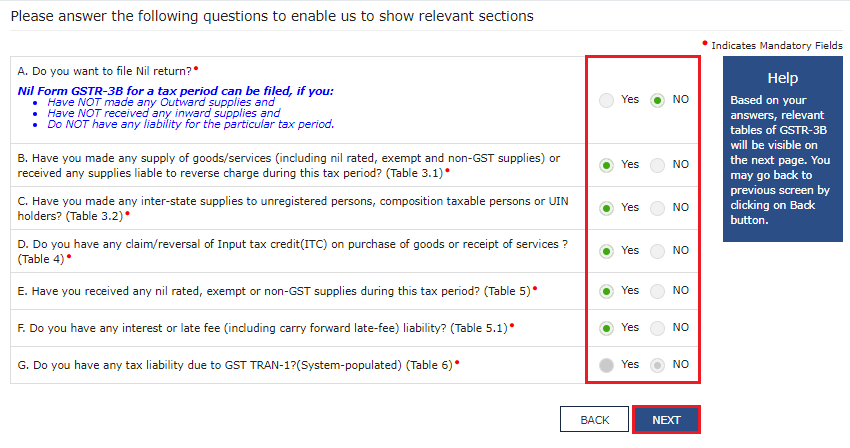

EWay Bill:-The Eway Bill is required for the commencement of movement of goods. if the GST registered taxpayer has not filed their GSTR-3B Return for the last two successive months/quarters or being a person paying tax under composition scheme has not furnished the statement in FORM GST CMP-08 for two consecutive quarters then GSTIN gets blocked for further generation of eway bills.

Step for Unblocking of E-Way Bill Generation Facility online

Following steps require to perform for Unblocking of E-Way Bill Generation Facility online on GST Portal:

A. File application for Unblocking of E-Way Bill Generation Facility on GST portal online

B. View Filed Application online

C. View issued Notice related to Application and File the Reply against the notice online

D. View issued Orders related to Application online

A. File Application for Unblocking of E-Way Bill Generation Facility on GST portal:-

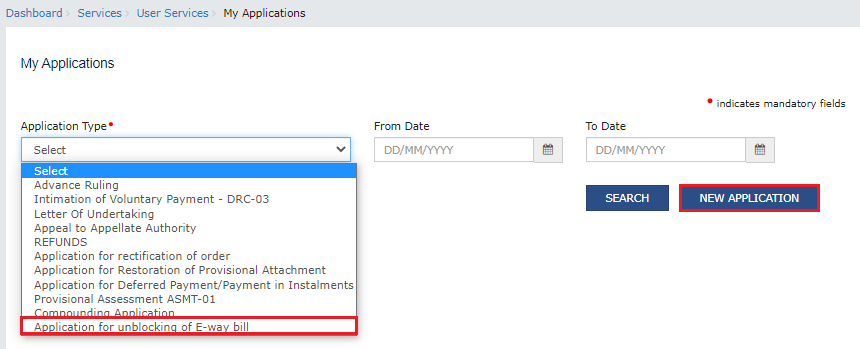

1. Taxpayer require to access the gst.gov.in URL. On this site the GST Home page is displayed. Login to the portal with valid credentials of taxpayer. Dashboard page is displayed. Click Services > User Services > My Applications option.

2. The My Applications page is displayed on portal. Taxpayer require to select Application for unblocking of E-way bill in the Application Type field. Click the NEW APPLICATION button.

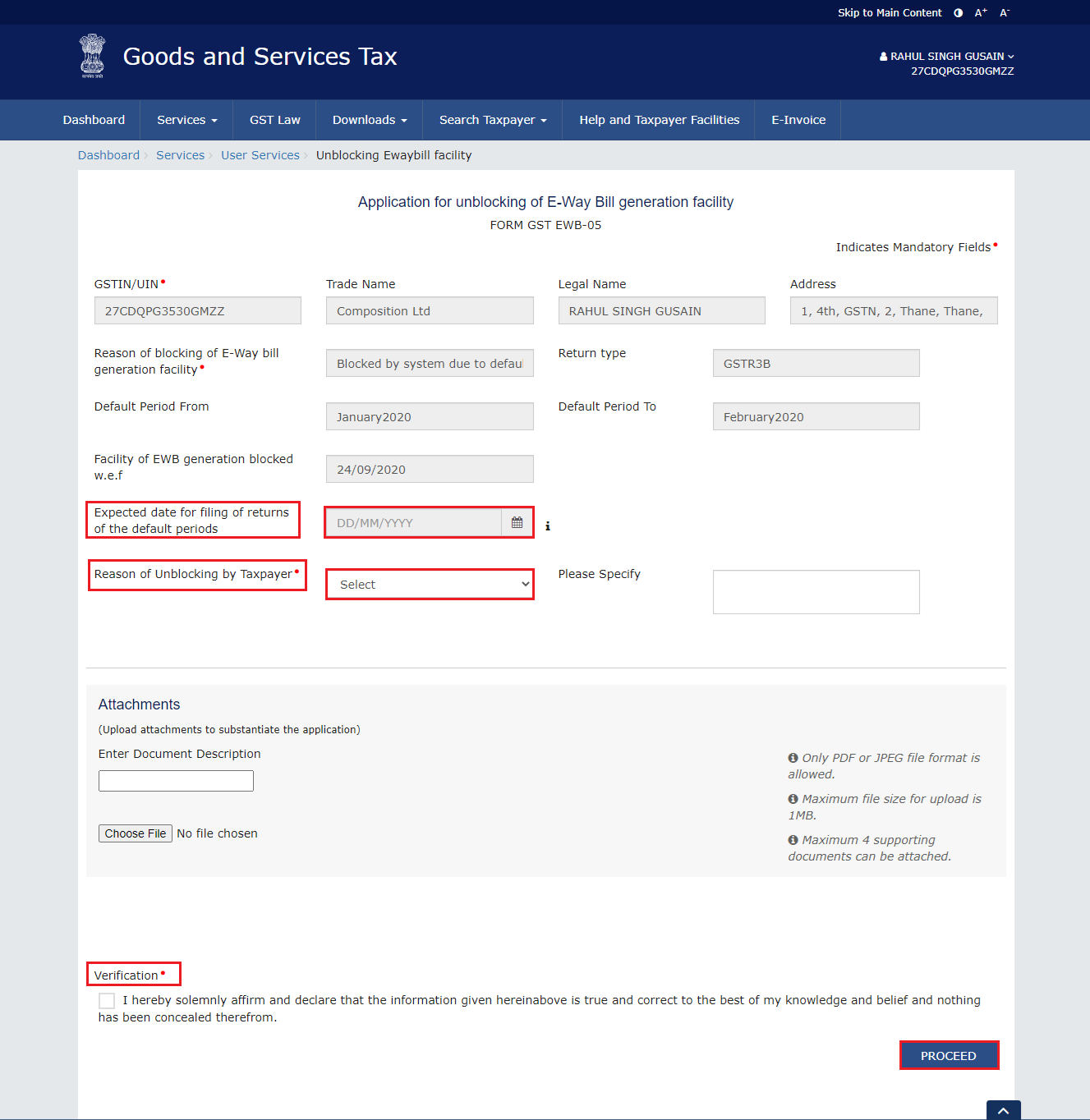

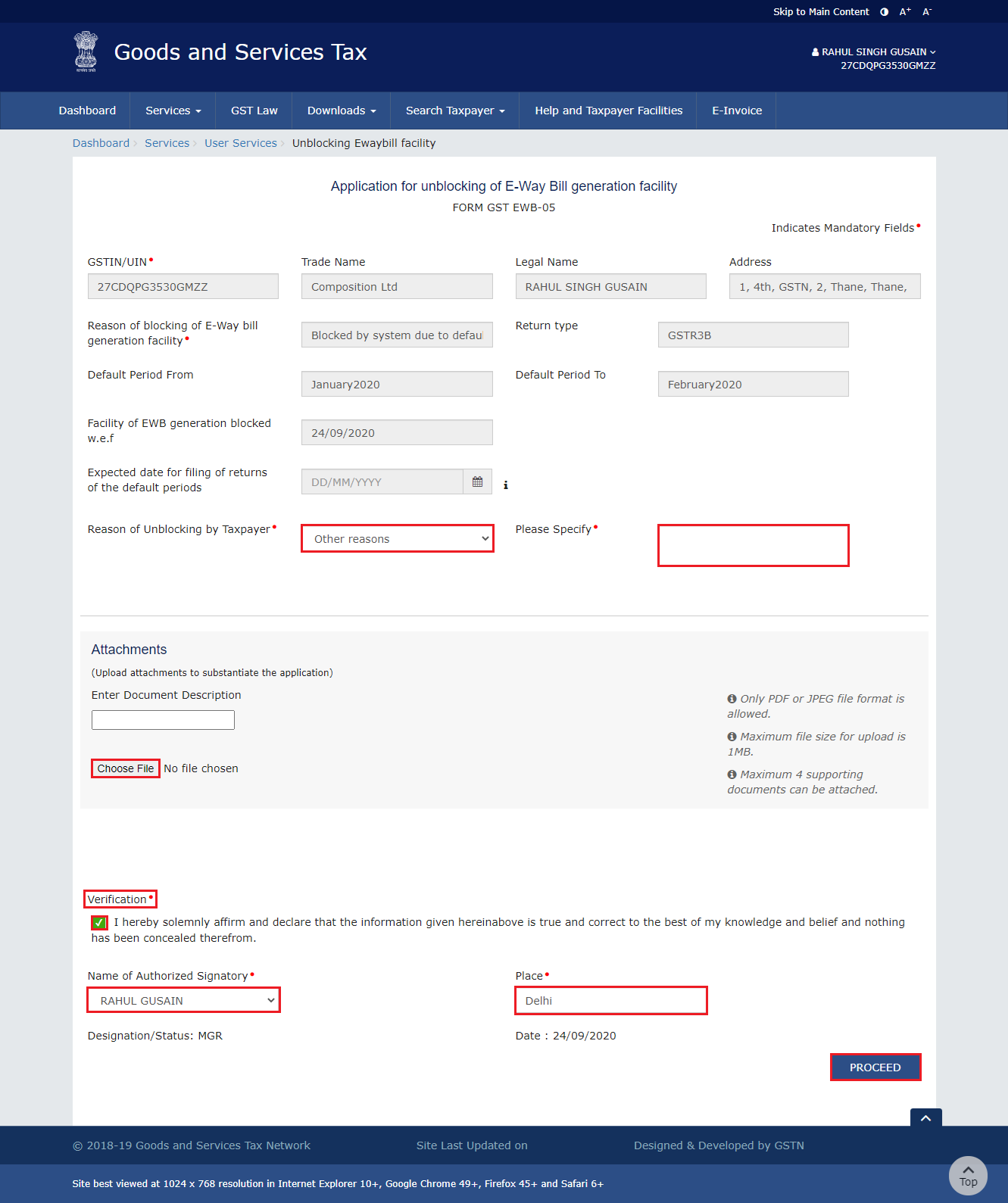

3. The Application for unblocking of E-way bill page is displayed on gst portal.

4.Taxpayer require to select the Expected date for filing of returns of the default periods using the calendar showing on portal.

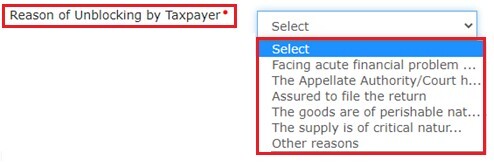

5.Select the Reason of Unblocking by Taxpayer from the drop-down list.

Note: If Other reasons is selected as the Reason of Unblocking then specify the reason in the box provided next to it.

6. Click Choose File to upload the document(s) related to this application on portal.

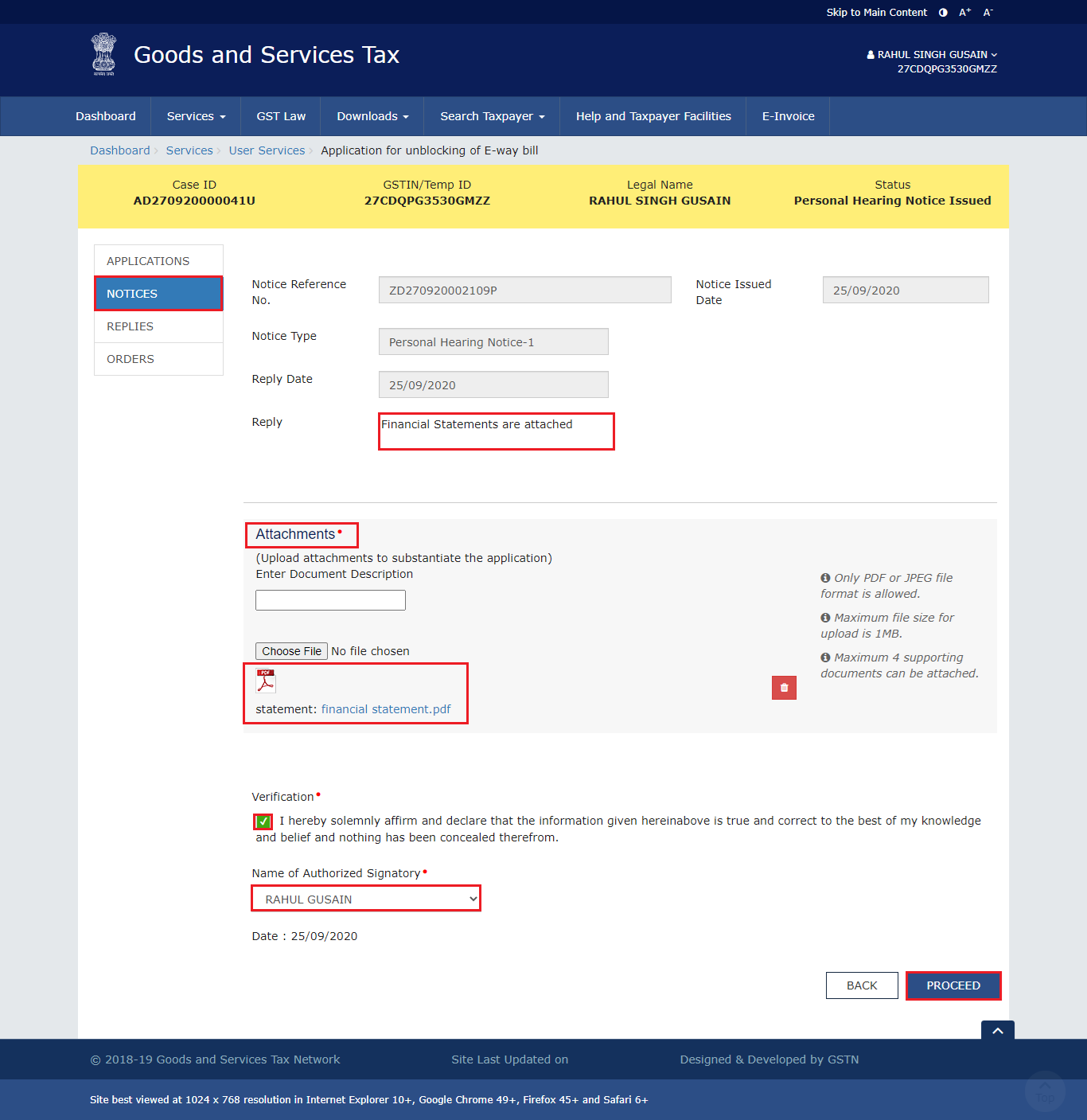

Note:

- Only PDF or JPEG file format is allowed for upload.

- Maximum file size for upload is 1MB.

- Maximum 4 supporting documents can be attached.

7. Taxpayer require to select the Verification check-box and Name of the Authorized Signatory from the drop-down list. Enter the name of the Place where taxpayer are filing this application and then click the PROCEED button of application.

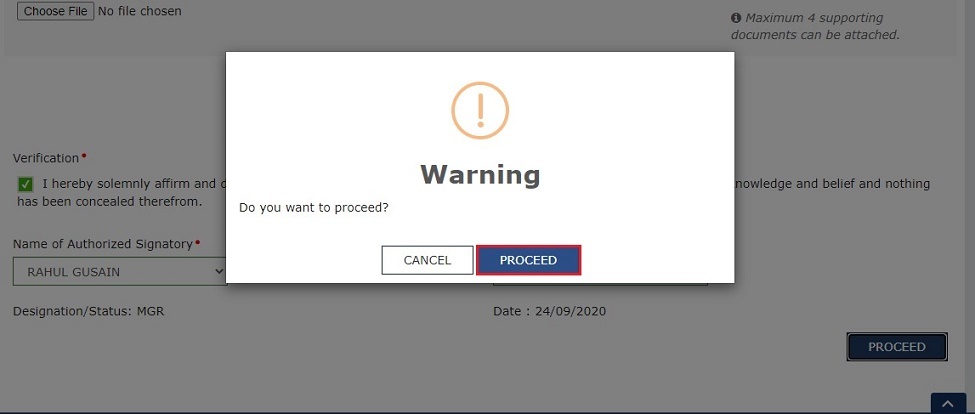

8. Click the PROCEED button.

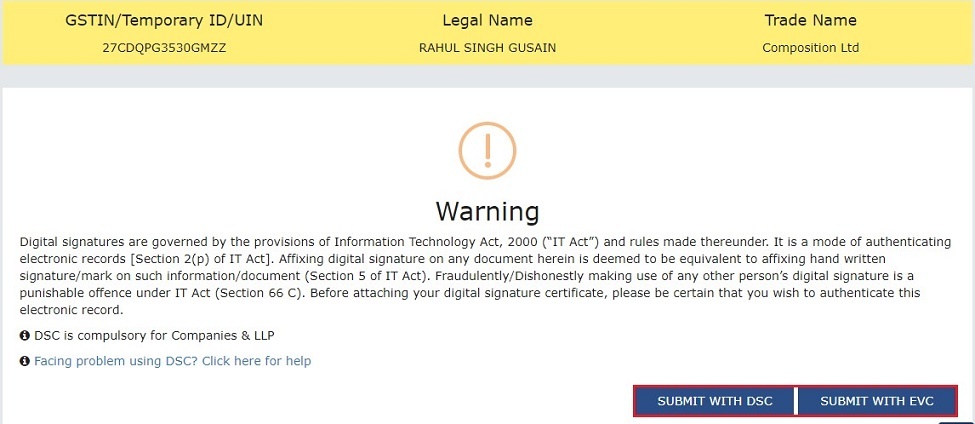

9. The Submit Application page is displayed. Taxpayer can either Click on SUBMIT WITH DSC or SUBMIT WITH EVC.

10 (a) Method 1 SUBMIT WITH DSC: Click the PROCEED button and Select the certificate and click the SIGN button.

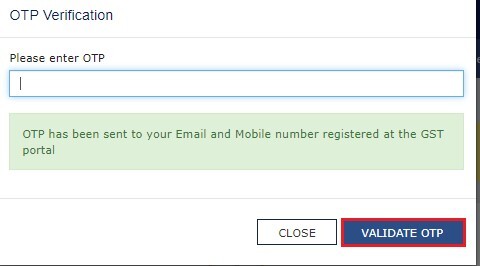

10 (b) Method 2 SUBMIT WITH EVC: Enter the OTP received on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VALIDATE OTP button.

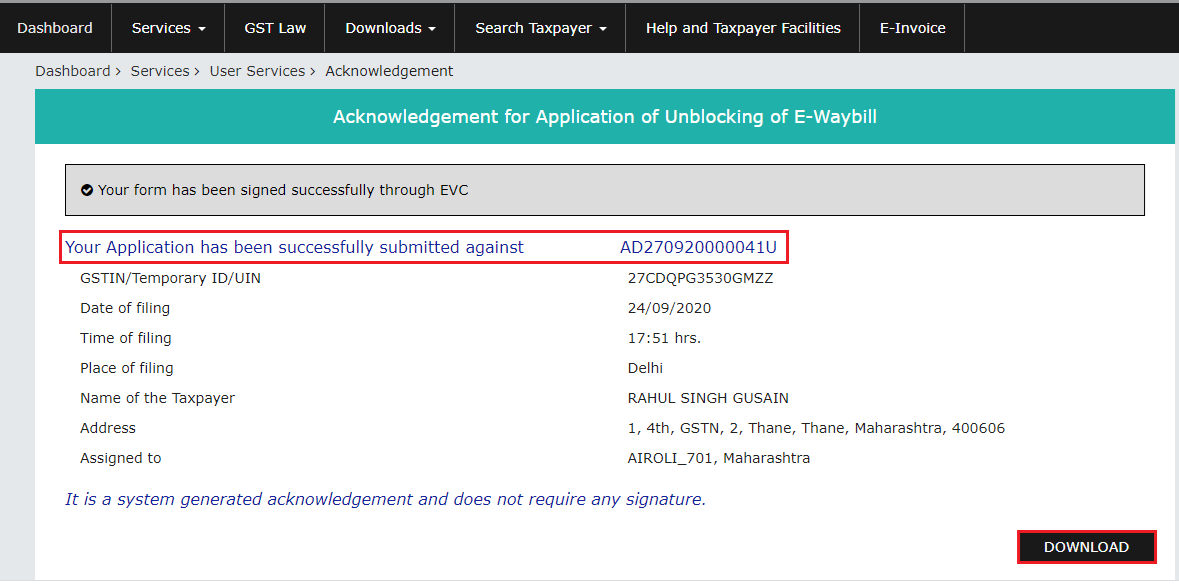

11. The Acknowledgement page is displayed with the generated ARN after successful submit of application on portal. Taxpayer will also receive an SMS and email on registered mobile number & e-mail id respectively, intimating of the generated ARN and successful filing of the application.

Note: Once the application is filed on portal, the status of the application gets updated to "Pending with Tax Officer".

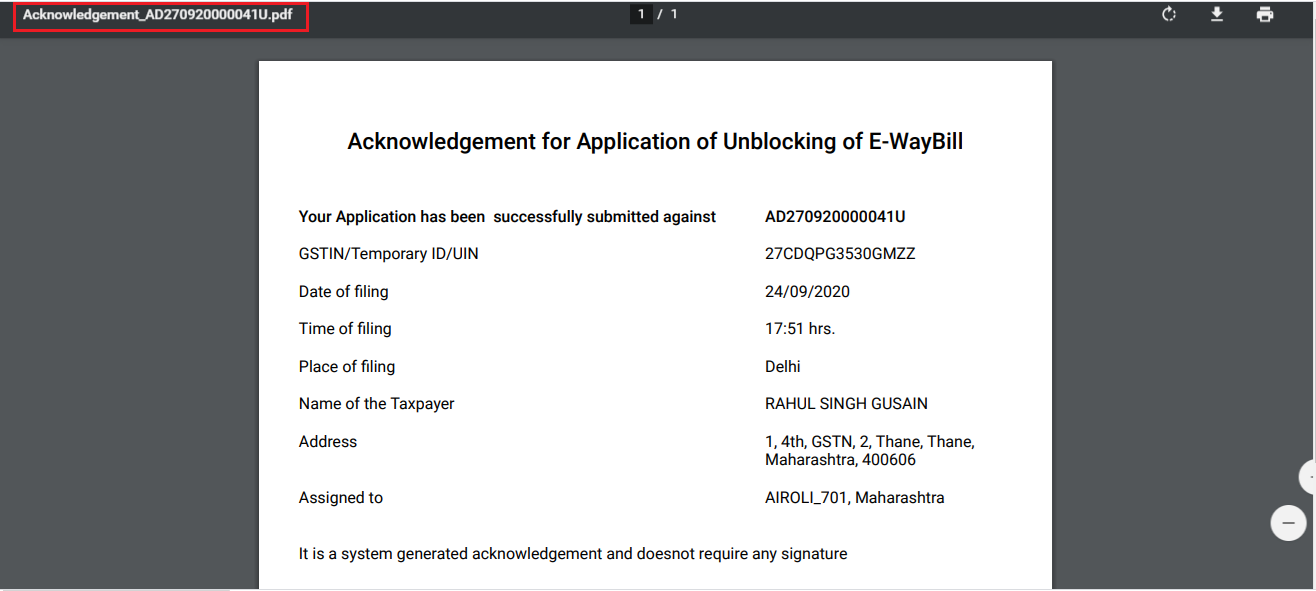

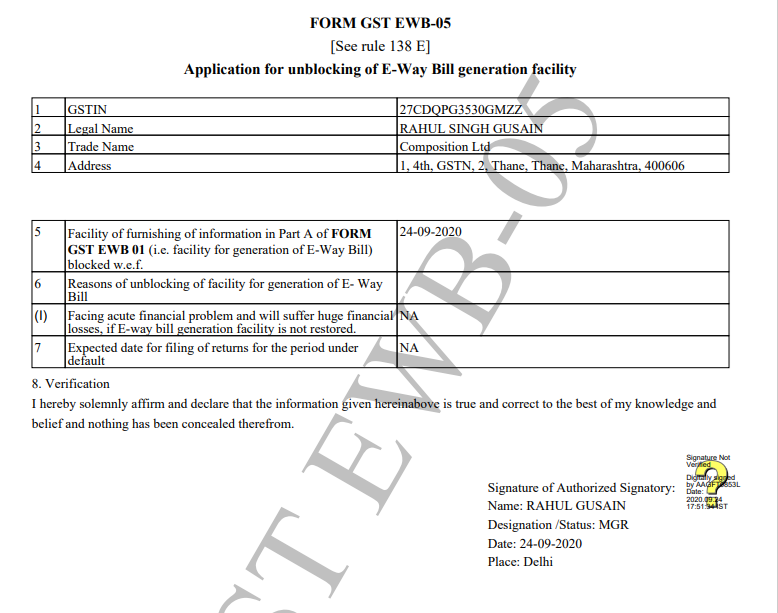

11.1 Usre can download the filed application for Unblocking of E-Way Bill Generation Facility by click the DOWNLOAD button.

11.2. The filed application is displayed in PDF format and user can save it.

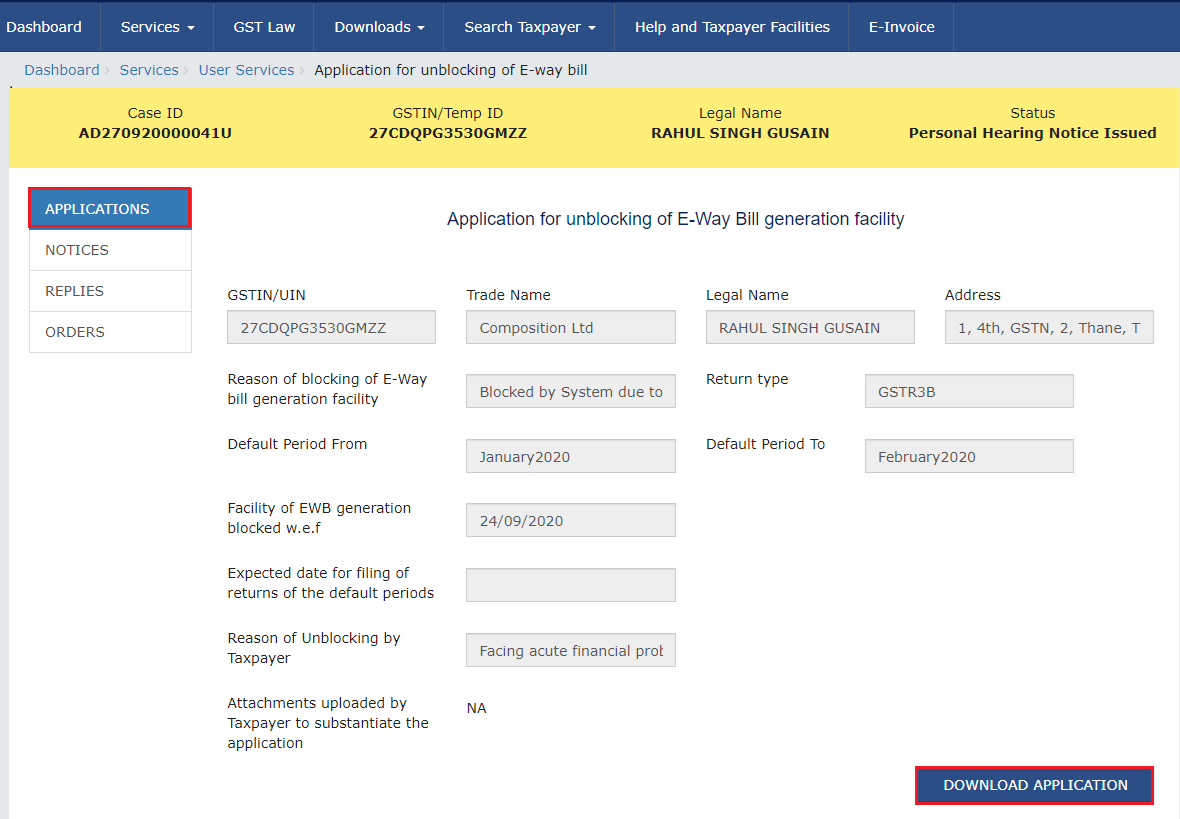

B. View Filed Application online:-

To view details of unblocking application filed, taxpayer can perform the following steps on gst portal:

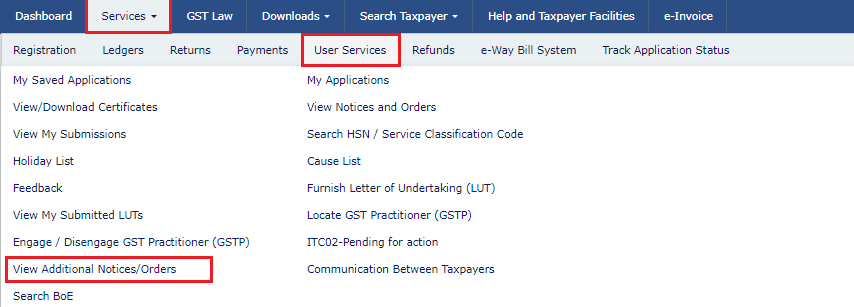

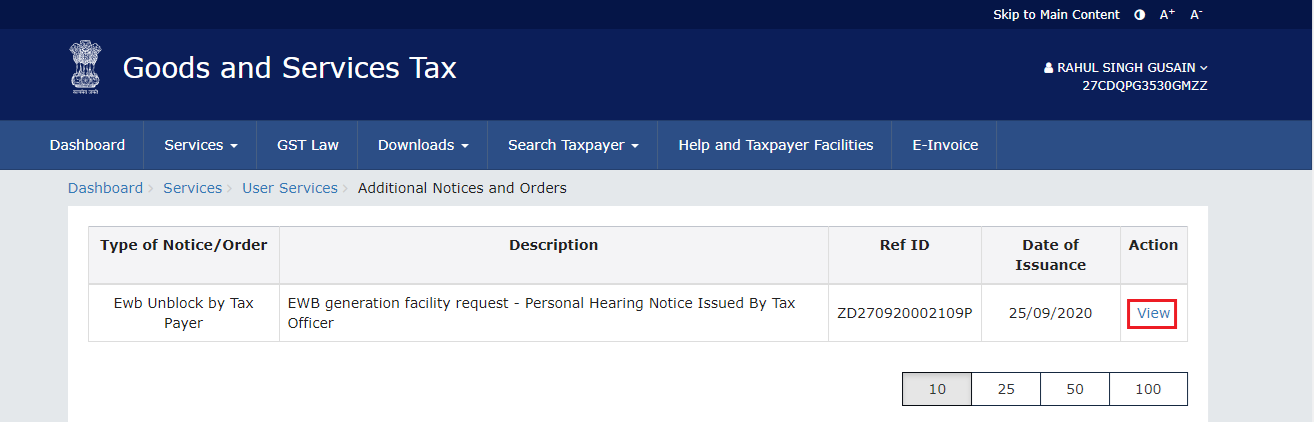

12. Navigate to Services > User Services > View Additional Notices/Orders option.

12.1. Click View.

13. On the Case Details page of that particular application, select the APPLICATIONS tab, if it is not selected by default. This tab provides you an option to view the filed application in PDF format. Click the DOWNLOAD APPLICATION button to download and view the application in PDF mode.

13.1. The file application is displayed in PDF format.

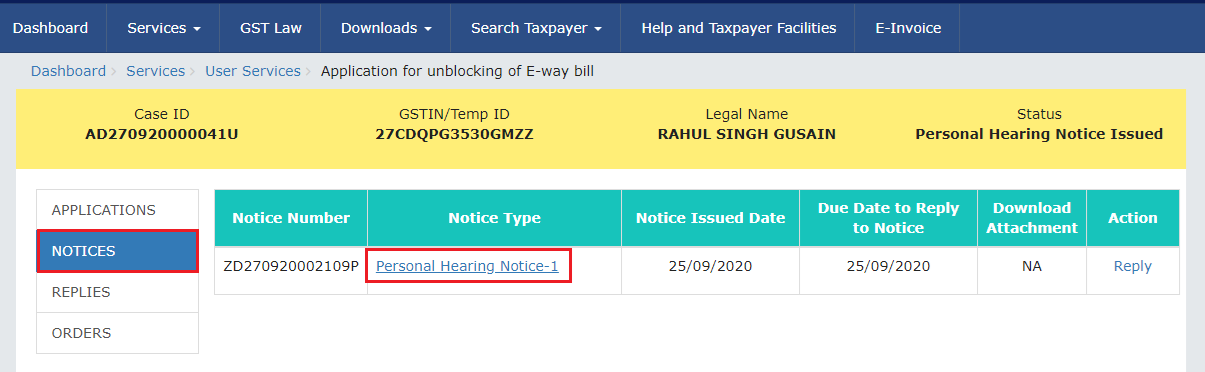

C. View issued Notice related to Application and File the Reply against the notice online

To view Notices issued by tax official to you related to your application and to file your Reply to it, perform following steps:

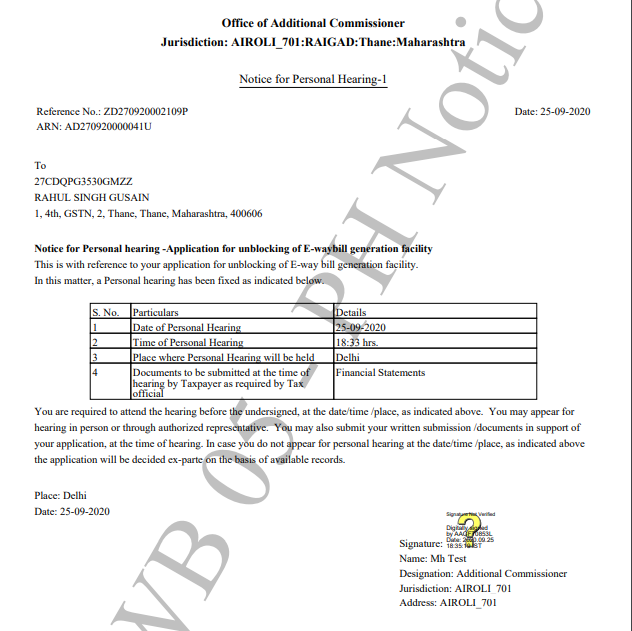

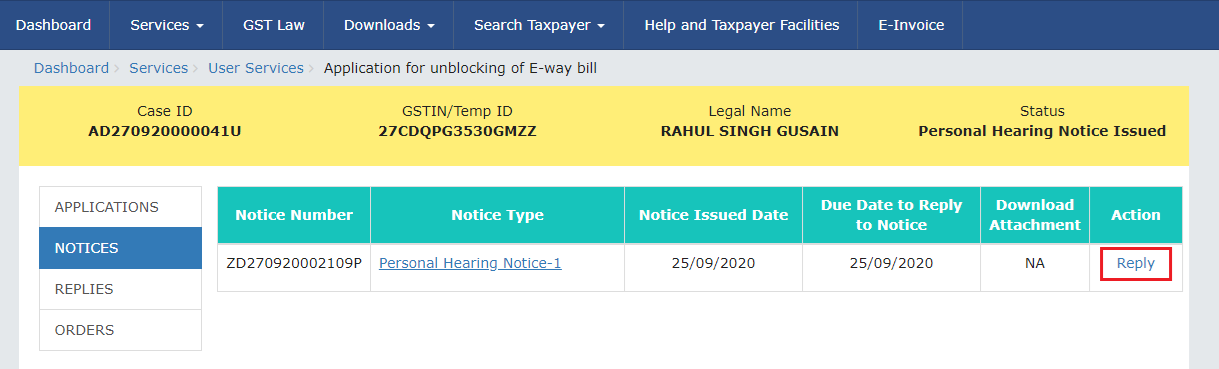

14. On the Case Details page of that particular application on portal, select the NOTICES tab. This tab displays all the notices issued by Tax Official against the application. Click on the Notice Type to download the personal hearing notice in PDF format.

14.1. The personal hearing notice is displayed in PDF format.

Note: The Download Attachment column shows the link to view or download the supporting documents attached by Tax Official, if any, while issuance of the said notice.

15.1 To reply to the issued Notice, click on Reply hyperlink given on this page.

16. After click on this hyperlink, the Notice Reference Number, Notice Issued Date, Notice Type and Replay Date fields are auto populated. In the Reply field, enter details of reply to the issued notice and the after Click on Choose File to upload the document(s) related to reply. Select the Verification check box and select the Name of Authorized Signatory from the drop-down list. Click PROCEED after enter details of reply.

Note:

- Only PDF or JPEG file format is allowed.

- Maximum file size for upload is 1MB.

- Maximum 4 supporting documents can be attached.

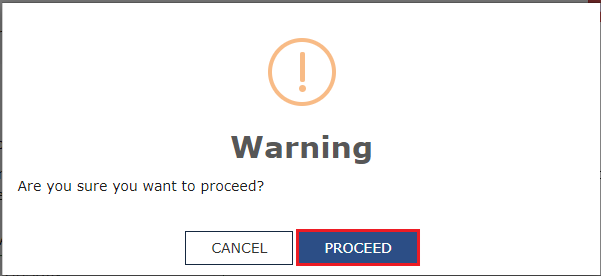

17. Click the PROCEED button.

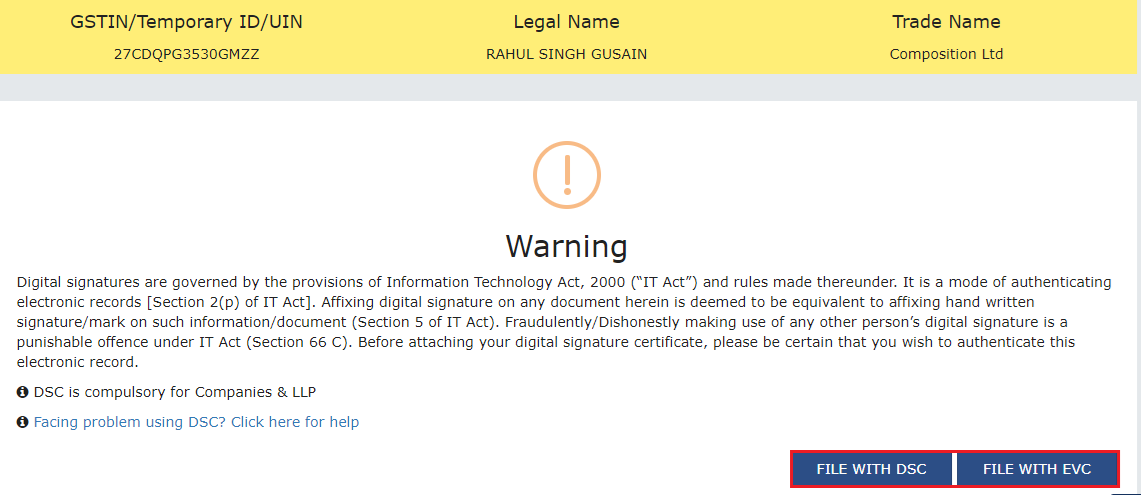

18. The Submit Application page is displayed. Click FILE WITH DSC or FILE WITH EVC.

- (a)FILE WITH DSC:Click the PROCEED button. Select the certificate and click the SIGN button.

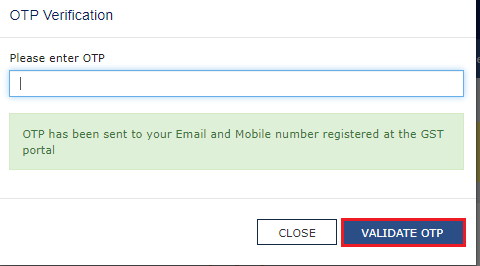

- (b)FILE WITH EVC:Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VALIDATE OTP button.

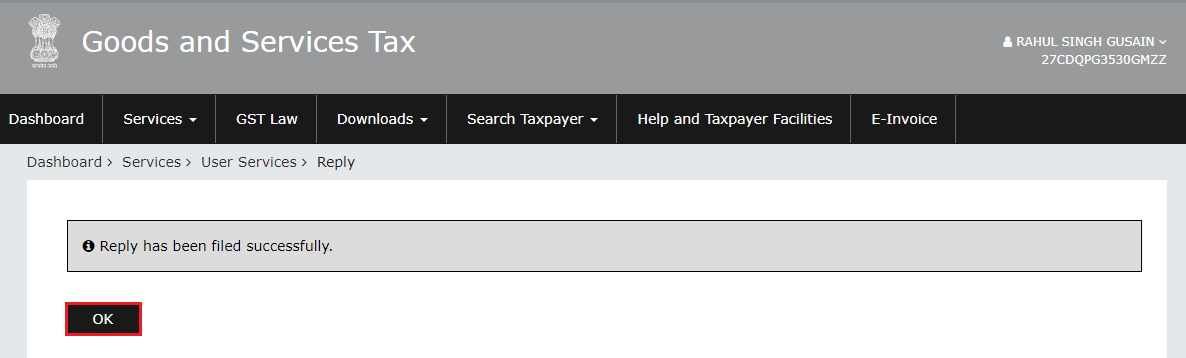

19. A confirmation message is displayed that reply has been filed successfully. Click OK.

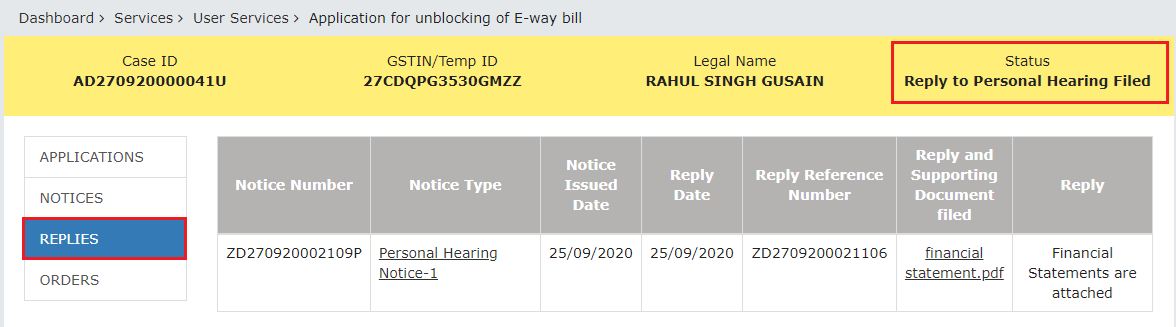

20. The updated REPLIES tab is displayed, with the record of the filed reply in a table and with the Status updated to "Reply to Personal Hearing Filed". You can also click the documents in the Reply Filed section of the table to download them.

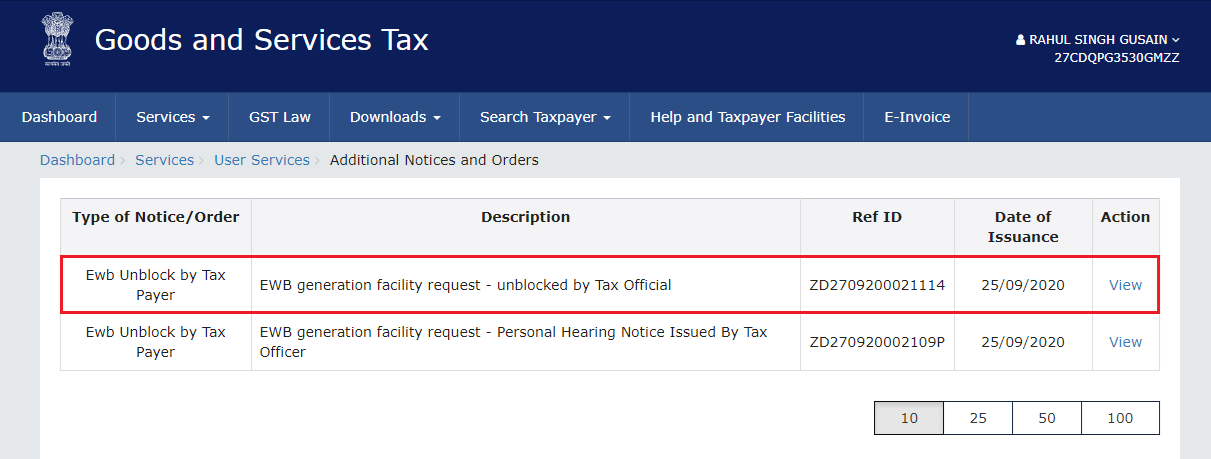

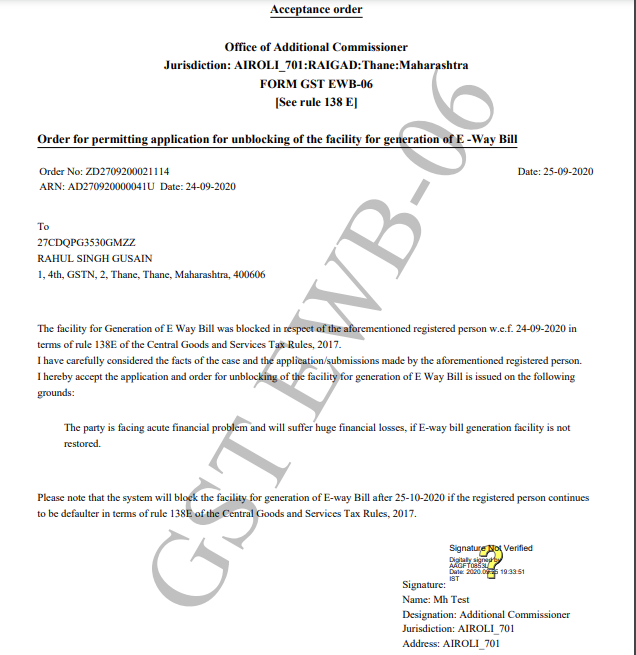

D. View issued Orders related to Application online

To download order issued by tax official regarding acceptance or rejection of Unblocking of E-Way Bill Generation Facility, Taxpayer require to perform following steps:

1. On the Case Details page of that particular taxpayer on portal, click on the ORDERS tab. This tab provides an option to view the issued order, in PDF mode. Click the order in the Order Type section of the table to download file in PDF format.

21.1 The PDF document is displayed as shown below.

Note: Unblocking of an E-Way Bill generation facility is valid upto the period indicated by the Tax Official in his/her order.

Post the expiry of the validity period, the taxpayer will continue to be unblocked in the E-way bill system for generation of EWB, if the taxpayer is not in the defaulter list, after expiry of validity period.

Post the expiry of the validity period, the taxpayer will be automatically blocked in the E-way bill system, if the taxpayer is still in the defaulter list, after expiry of validity period. This will happen if taxpayer fails to file Form GSTR-3B return / Statement in FORM CMP-08 for last two or more consecutive tax periods, after expiry of validity period.