How to File ITR on New Income Tax Portal

Every person who has a total income that exceeds the basic exemption limit is liable to furnish Income Tax Return (ITR) within the due date of filing ITR. A person can file and submit ITR (Income Tax Return) through the following methods online on new e-Filing income tax portal.

(A) Online Mode – through new e-Filing income tax portal

(B) Offline Mode – through Offline JSON Utility

Follow the steps below to file and submit the ITR through online mode. For online mode, first go to the new income tax e-Filing portal https://eportal.incometax.gov.in/

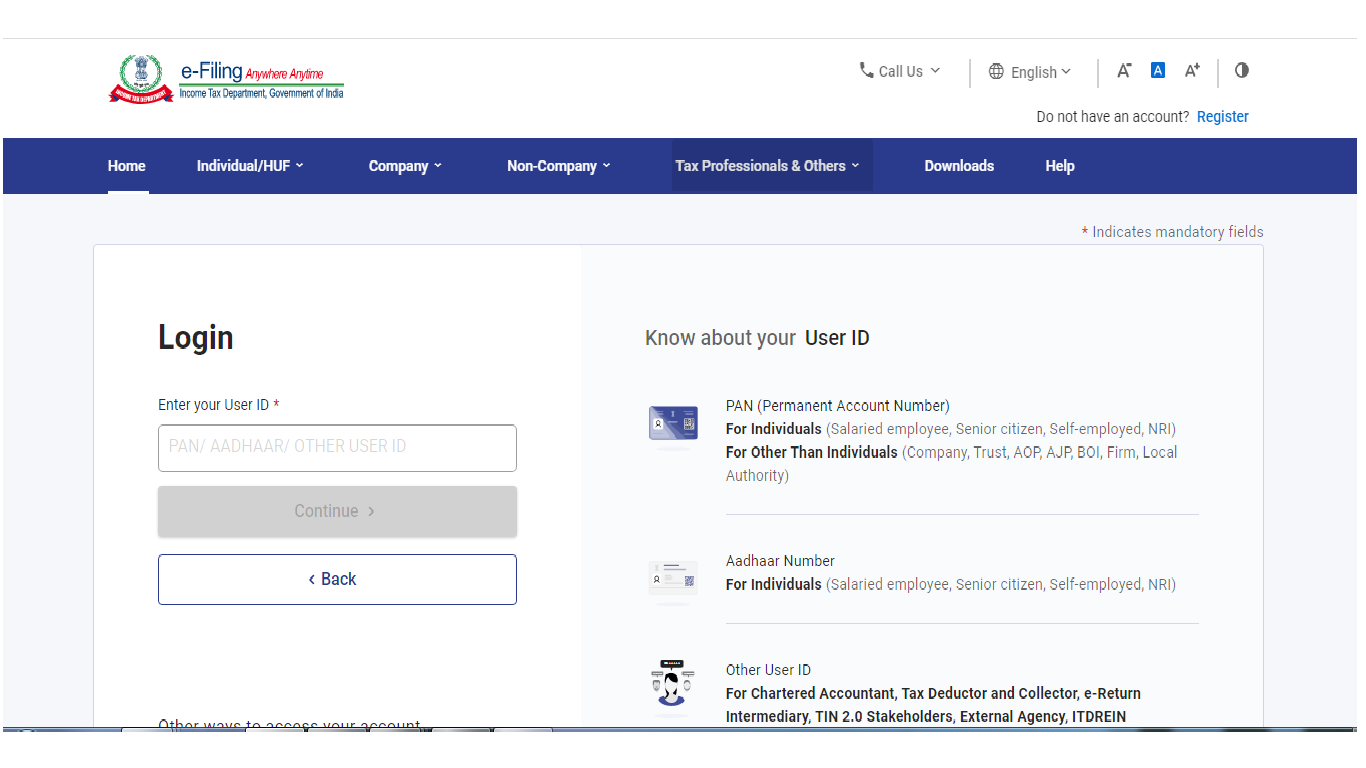

Step 1: Log in to the e-Filing portal using user ID (As PAN No.) and password to file ITR.

If the taxpayer has no user ID and password then before log in, he can register himself by using valid PAN and other details.

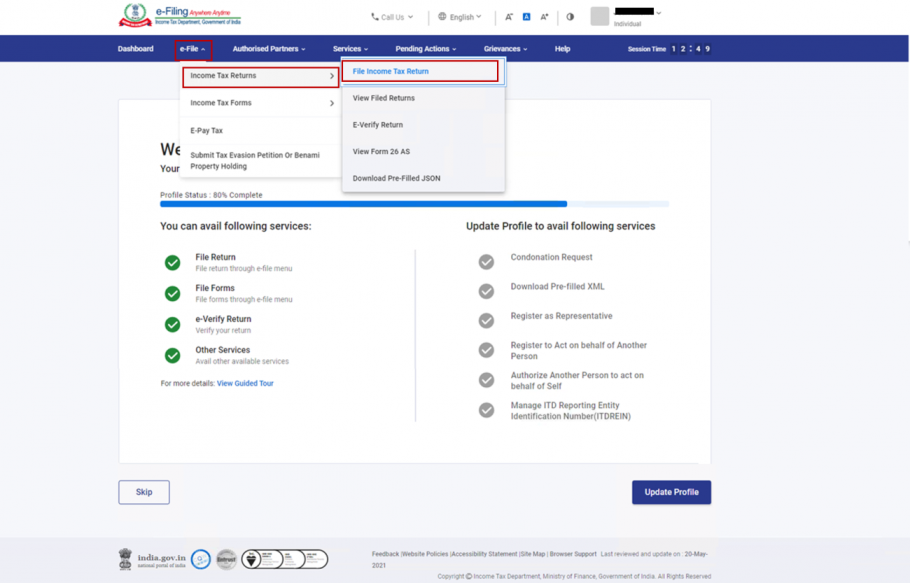

Step 2: After log in to the e-Filing portal, on dashboard, click e-File > Income Tax Returns > File Income Tax Return.

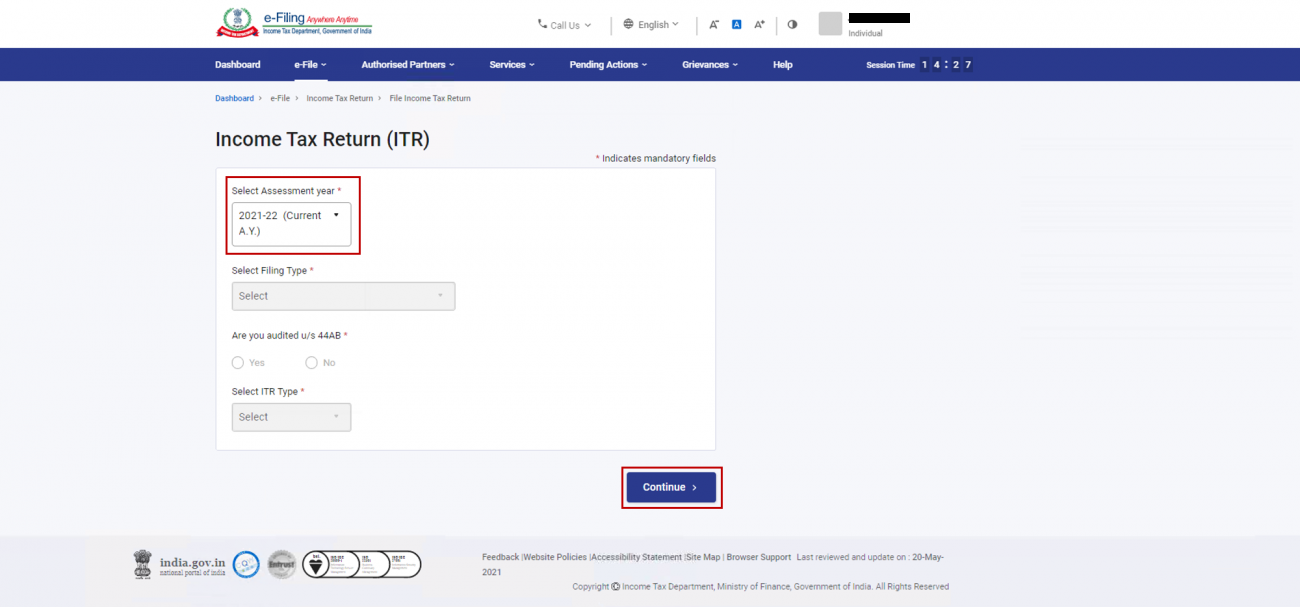

Step 3: Select Assessment Year for which ITR need to be file and click Continue.

Financial Year is the year in which taxpayer earn an income. Assessment Year is the year following the financial year in which taxpayer have to compute the previous year's income and pay taxes on it.

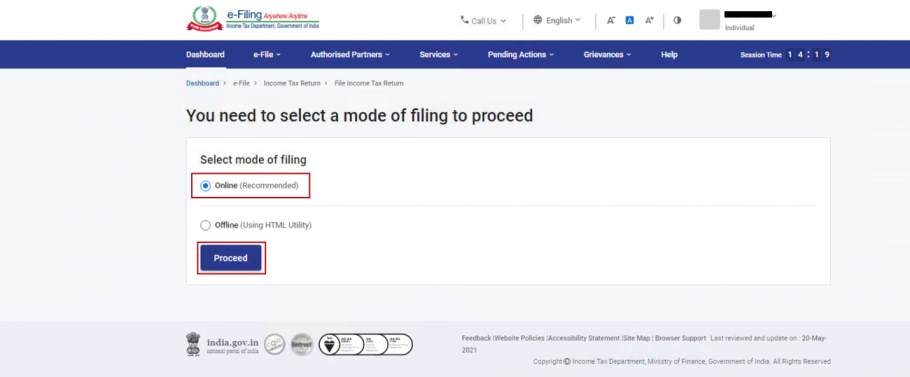

Step 4: There are two mode of filing of ITR (1) Online (2) Offline. Select Mode of ITR Filing as Online and click Proceed.

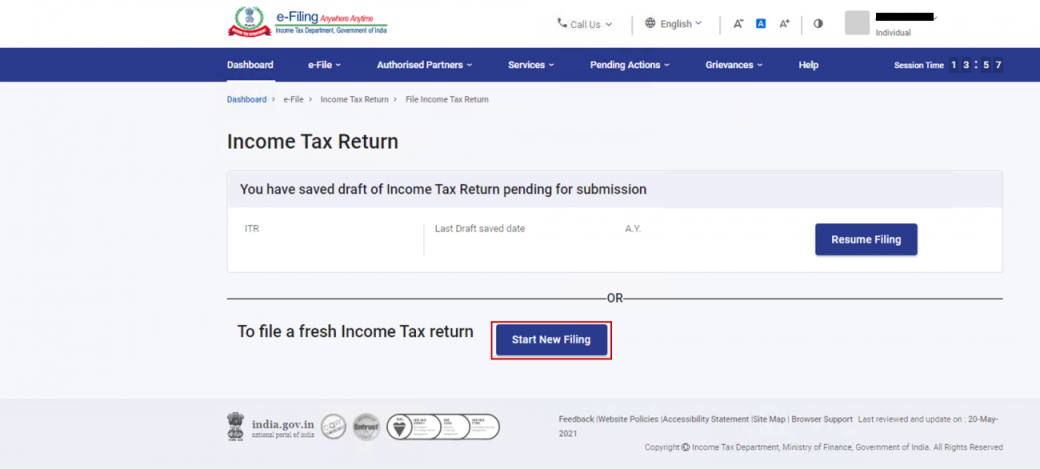

Note: In case any person has already filled the Income Tax Return and it is pending for submission, click Resume Filing. In case any person wish to discard the saved return and start preparing the return afresh click Start New Filing.

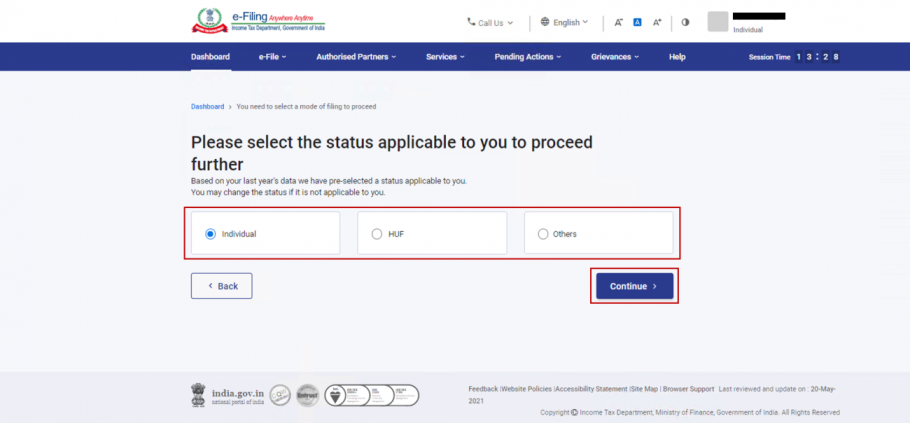

Step 5: Select Status as applicable and click Continue to proceed further. There are three type of status (1) Individual (2) HUF (3) Others. A user require to select one option as applicable.

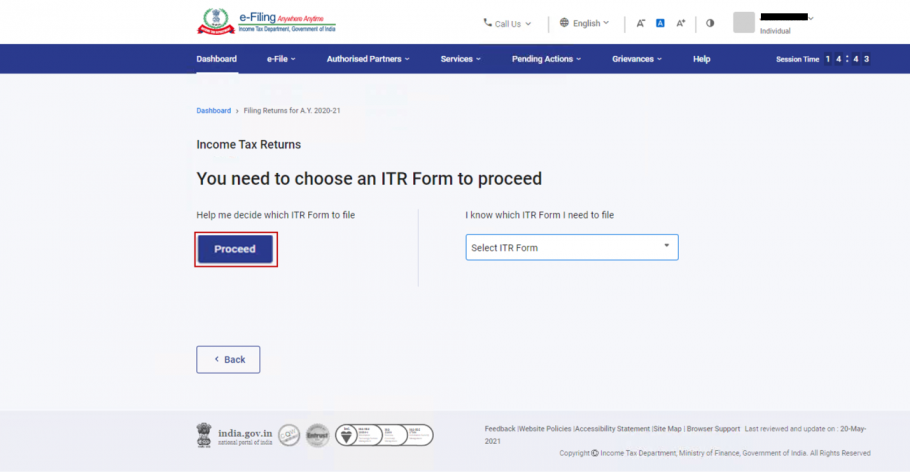

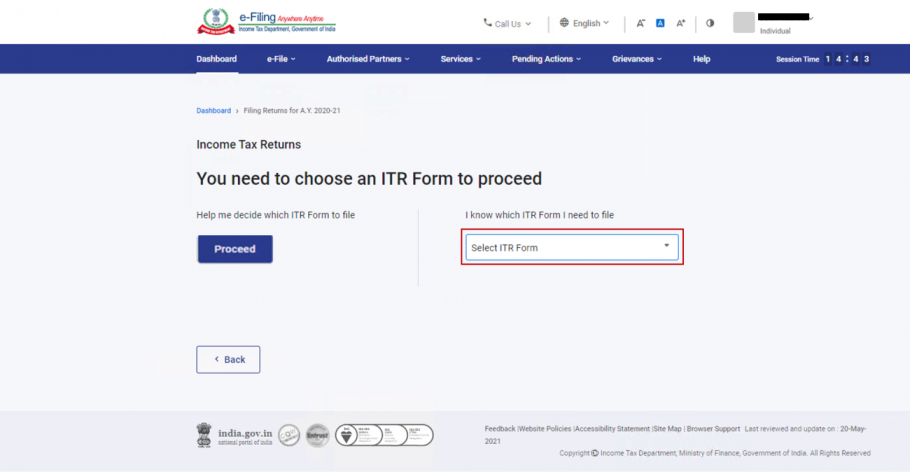

Step 6: There are two options to select the type of Income Tax Return (ITR) as applicable to assessee:

If any person is not sure which ITR need to file then he may select "Help me decide which ITR Form to file" and click Proceed. Once the system helps in determining the correct ITR, user can proceed with filing your ITR.

If any person is sure which ITR need to file, select "I know which ITR Form I need to file". Select the applicable Income Tax Return (ITR) from the dropdown and click Proceed with ITR.

Note:

(A) In case you are not aware which ITR or schedules are applicable to you or income and deductions details, your answers in response to a set of questions will guide in determining the same and help you in correct / error free filing of ITR.

(B) In case you are aware of the ITR or schedules applicable to you or income and deduction details, you can skip these questions.

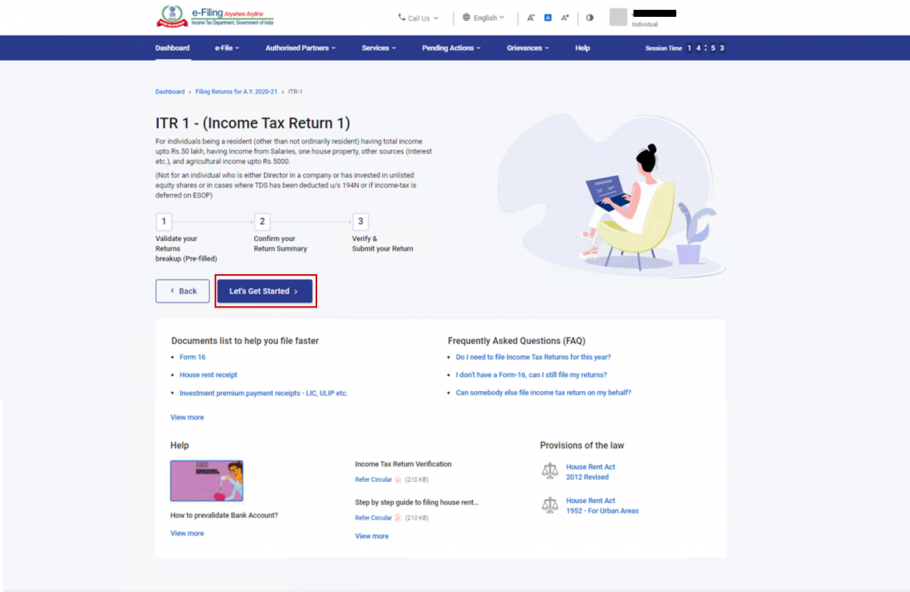

Step 7: Once a user have selected the ITR applicable, note the list of documents needed for file ITR and click on "Let’s Get Started".

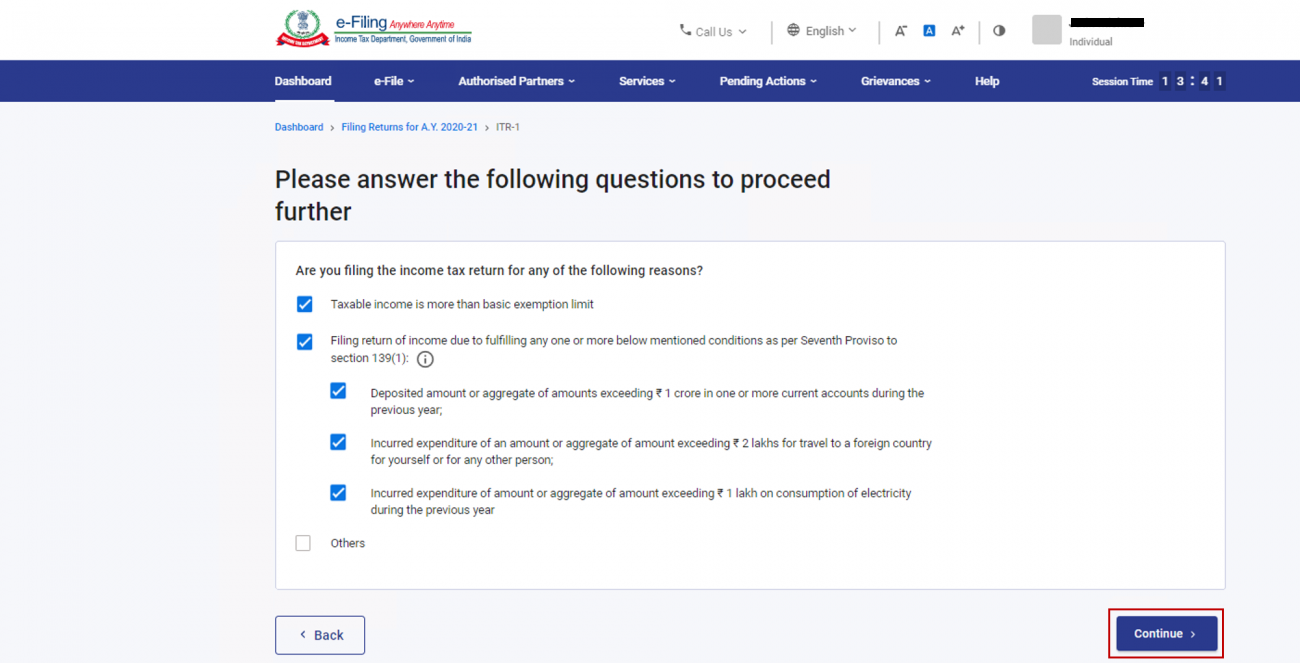

Step 8: Select the checkboxes applicable as per ITR and click Continue.

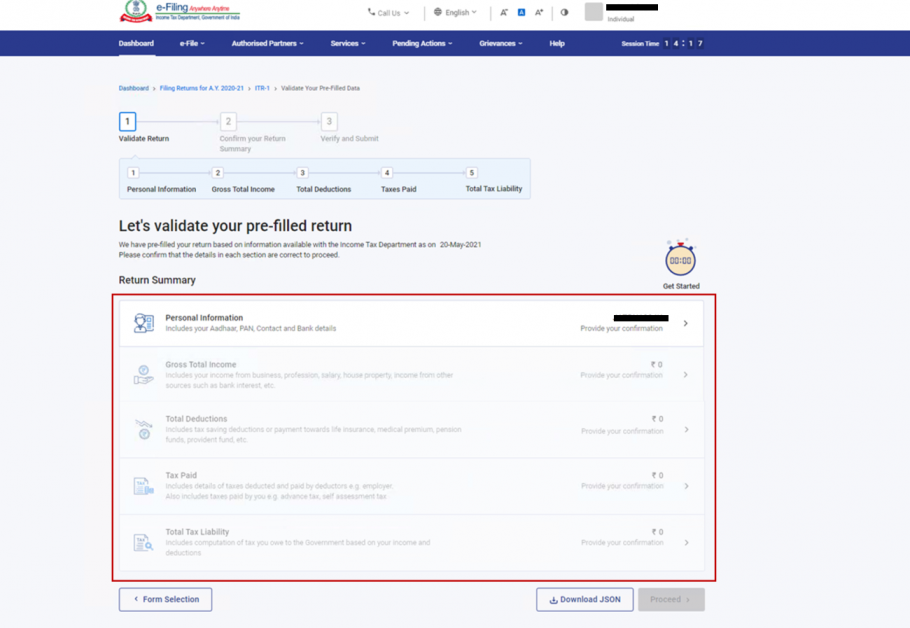

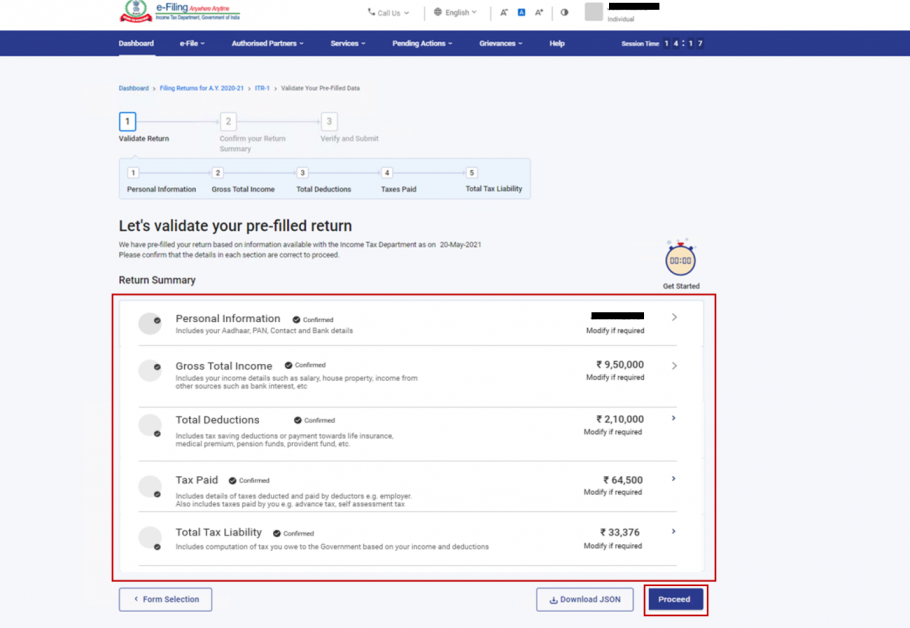

Step 9: Review pre-filled data and edit it if necessary. Enter the remaining / additional data (if required). Click Confirm at the end of each section

Step 10: Enter your income and deduction details in the different section which are:

(1) Personal Information:-Name, Date of Birth, Return filed under section, etc.

(2) Gross Total Income:- Income From Salary, House property, Business income, Capital Gain and Income From Other Source.

(3) Total Deduction:- Deduction for investment in LIC, Mutual fund, PF, etc.

(4) Tax Paid:- Tax already paid include TDS, Advance tax, Self assessment tax paid, etc.

(5) Total Tax Liability:- Tax Liability as system computed.

After completing and confirming all the sections of the form, click Proceed.

Step 10:

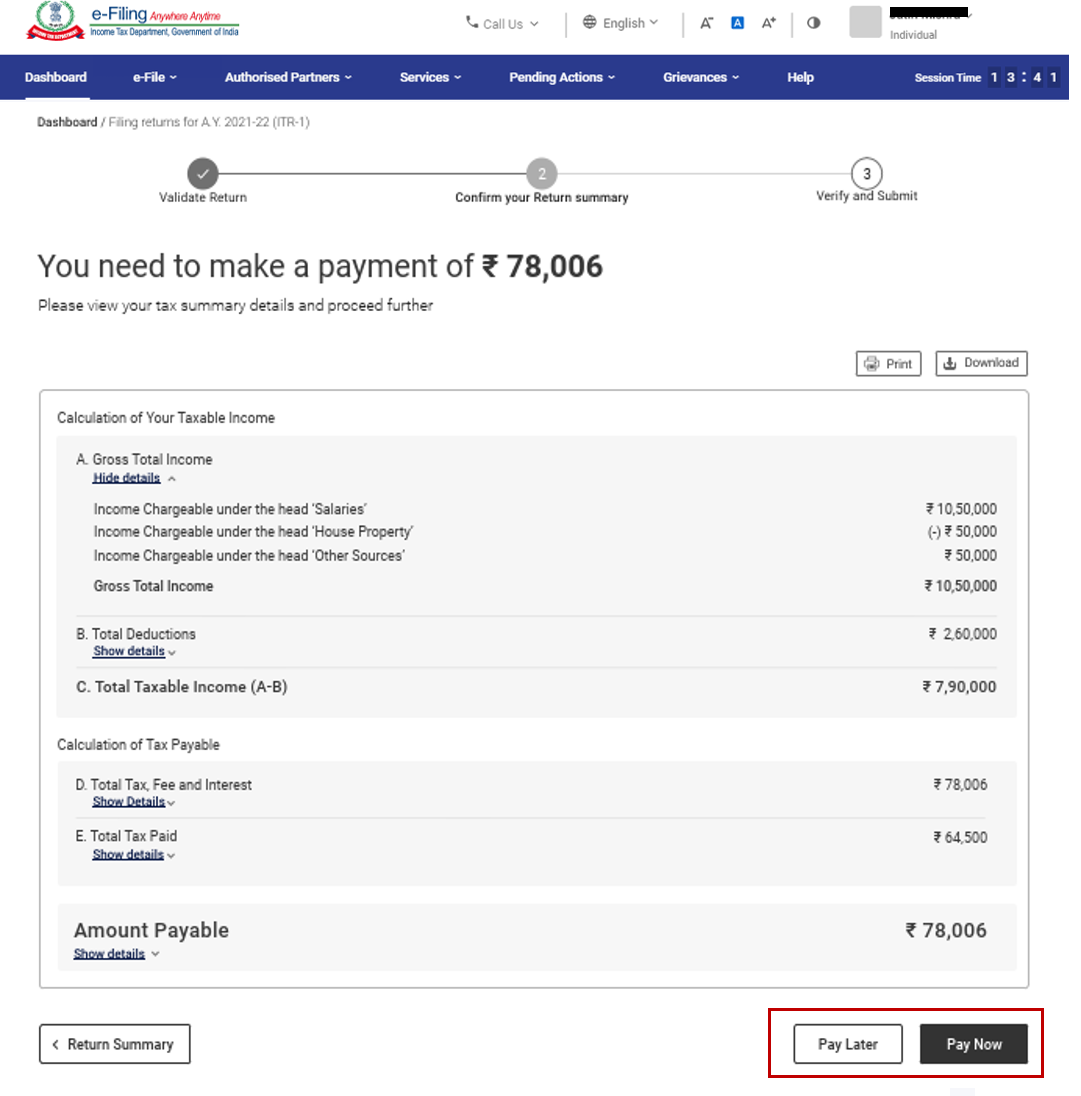

(A) In case there is a tax liability:- e-Filing income tax portal will be shown a summary of your tax computation based on the details provided by you. If there is tax liability payable based on the computation, you get the Pay Now and Pay Later options at the bottom of the page

Note:

- It is recommended to use the Pay Now option. After payment of Income Tax online, note the BSR Code and Challan Serial Number and enter them in the details of payment.

- If you opt to Pay Later, you can make the payment after filing your Income Tax Return.

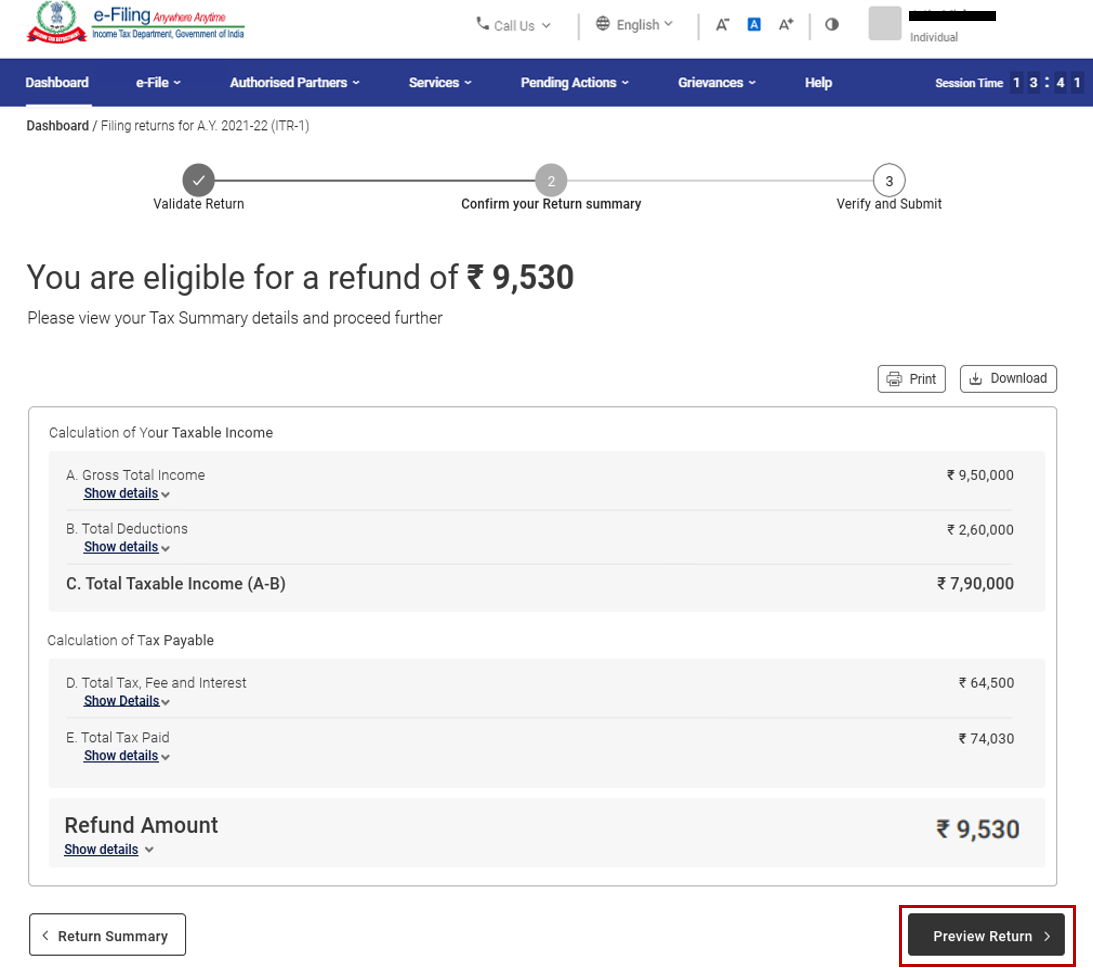

(B) In case there is no tax liability (No Demand / No Refund) or if you are eligible for a Refund

After paying tax, click Preview Return. If there is no tax liability payable, or if there is a refund based on tax computation, you will be taken to the Preview and Submit Your ITR page.

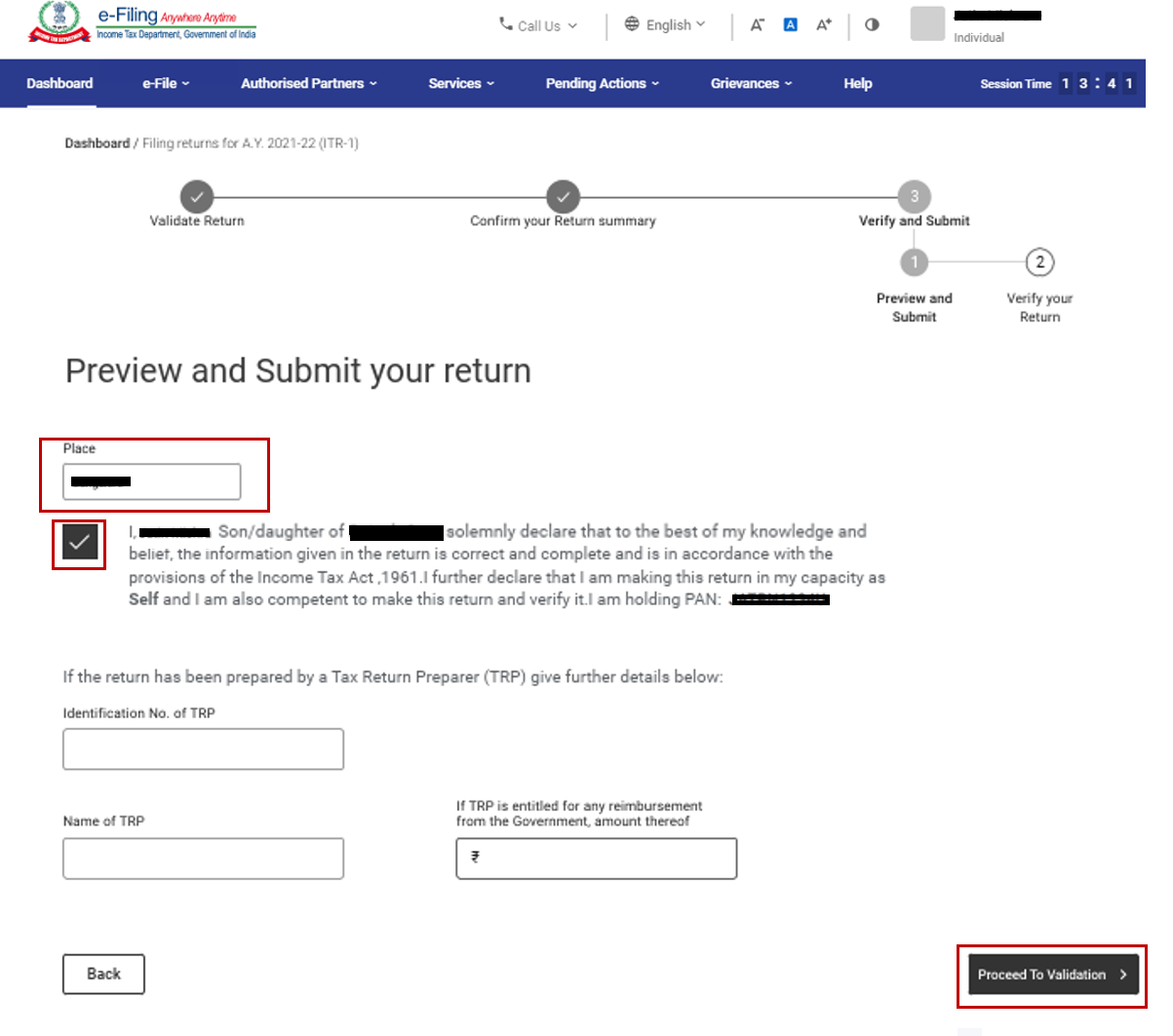

Step 11: On the Preview and Submit Your Return page, enter Place, select the declaration checkbox and click Proceed to Validation.

Note: If you have not involved a tax return preparer or TRP in preparing your return, you can leave the text boxes related to TRP blank.

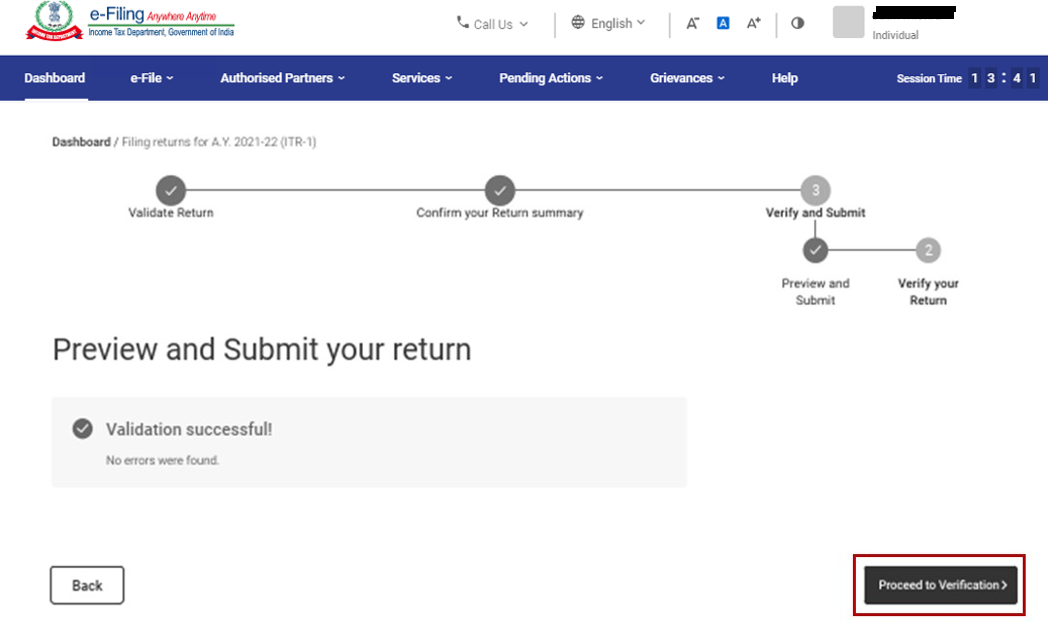

Step 12: Once validated, on your Preview and Submit your Return page, click Proceed to Verification.

Note: If you are shown a list of errors in your return, you need to go back to the form to correct the errors. If there are no errors, you can proceed to e-Verify your return by clicking Proceed to Verification.

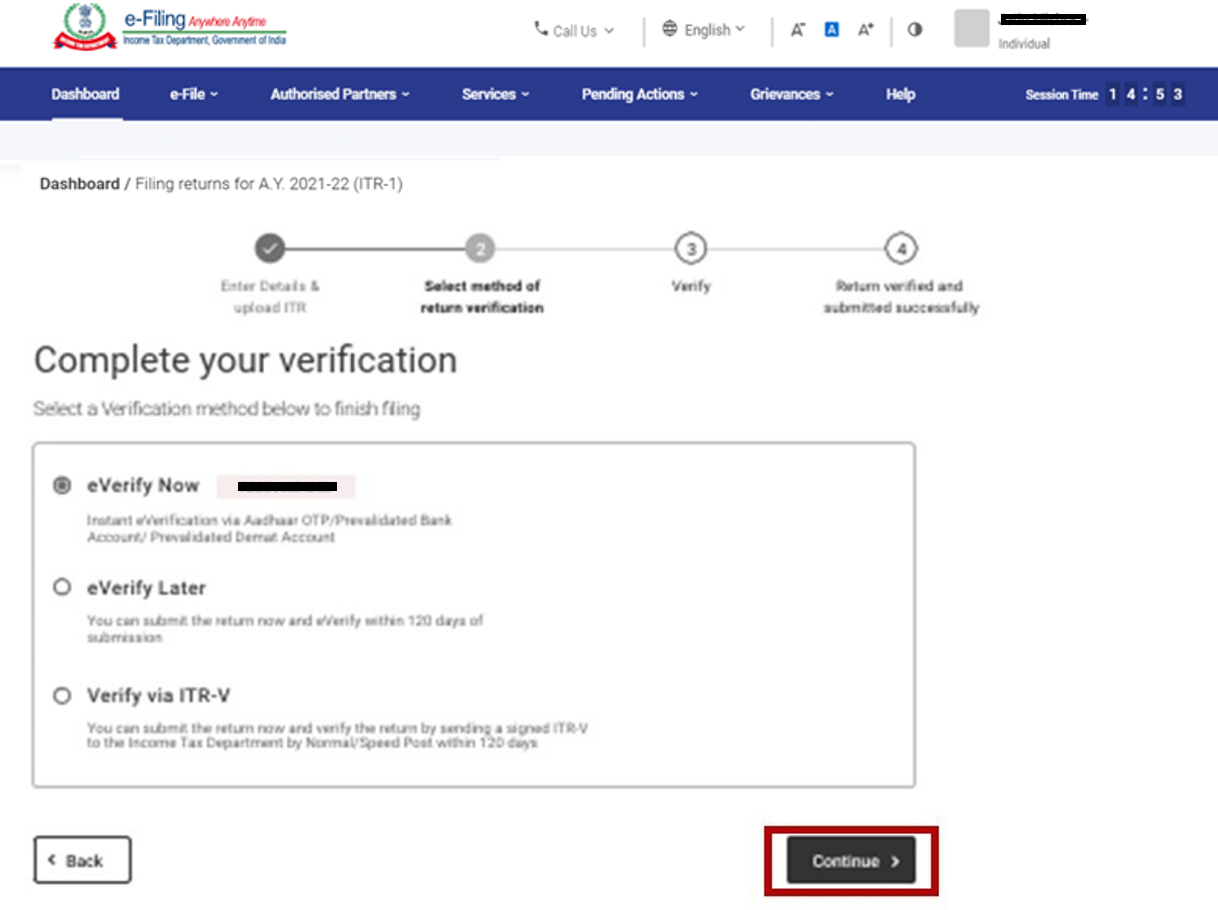

Step 13: On the Complete your Verification page, select your preferred option and click Continue.

It is mandatory to verify your return for a vailid ITR, and e-Verification is the easiest way to verify ITR.

Note: In case you select e-Verify Later, you can submit your return, however, you will be required to verify your return within 120 days of filing of your ITR.

Step 14: On the e-Verify page, select the option through which you want to e-Verify the return and click Continue.

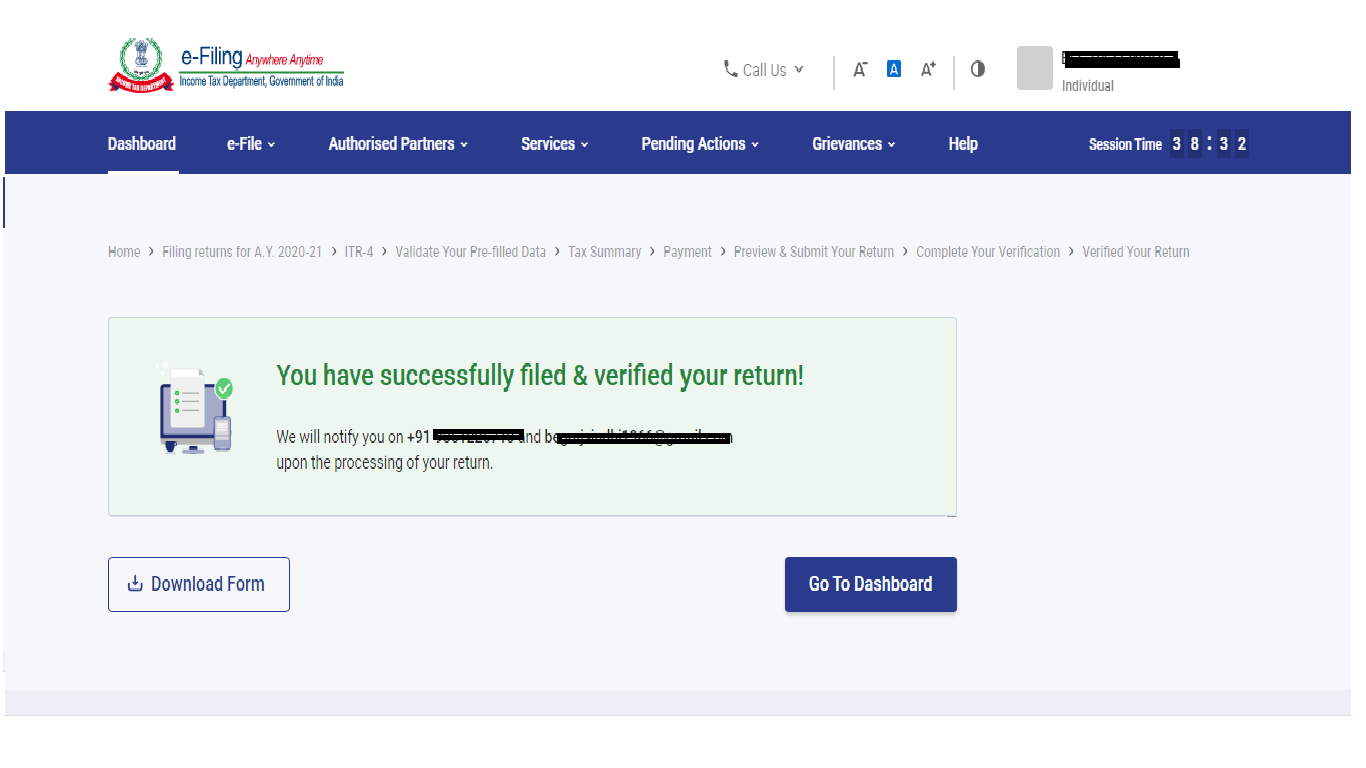

Once you e-Verify your return, a success message is displayed along with the Transaction ID and Acknowledgment Number. You will also receive a confirmation message on your mobile number and email ID registered on the e-Filing portal.