How to disclose financial statements in ITR-4

ITR-4

ITR-4 return is applicable for an Individual person or Hindu Undivided Family (HUF) having income from any of the following sources:

(1) Having total income up to Rs. 50 lakh during the year.

(2) Having income from Business and Profession which is computed on a presumptive basis. (Section 44AD / 44ADA / 44AE)

(3) Having income from Salary / Pension.

(4) Having income from One House Property

(5) Having income from Other sources (Interest, Family Pension, Dividend etc.)

(6) Agricultural Income up to Rs 5,000

Why do firms disclose financial information

Income from business (Section 44AD):- This section shall be applicable to resident Individual, HUF, Firm (excluding LLP) carrying on any business except the business of plying, hiring or leasing goods carriages referred to in section 44AE and whose total turnover or gross receipts in the previous year does not exceed an amount of 2 Crores. The main objective of this section is to provide relief to all the small businesses from maintaining the books of accounts and to reduce the compliance.

Under this section following shall deemed to be the profits and gains of such business chargeable to tax under the head “Profits and gains of business or profession”

(a) A sum equal to 8% of the total turnover or gross receipts of the assessees in the previous year

(b) A sum equal to 6% instead of 8% in respect of those portions of turnover/ sales/gross receipts if sales / gross receipts is received by an account payee cheque / draft / ECS through a bank account and payment is received during the previous year or before the due date of submission of return u/s 139(1) in the assessment year.

Income from business of hiring goods carriages (Section 44AE):- It provides a presumptive basis of taxation of income for estimating business income from plying, hiring or leasing goods carriages if the person own less than 10 vehicles at any time in the previous year.

Under this section following shall deemed to be the profits and gains of such business chargeable to tax under the head “Profits and gains of business or profession”

(a) In case of heavy goods vehicle (the gross vehicle weight of which exceeds 12,000 kilograms), the presumptive income would deemed to be an amount equal to Rs. 1,000 per ton of gross vehicle weight or unladen weight for every month during which the heavy goods vehicle is owned by the assessee in the previous year or an amount actually earned from such vehicle, whichever is higher.

(b) The vehicles other than heavy goods vehicle, the presumptive income would deemed to be an amount equal to Rs. 7,500 for every month during which the goods carriage is owned by the assessee in the previous year or an amount actually earned from such goods carriage, whichever is higher

Income from professionals (Section 44ADA):- This section allows presumptive basis, for a person who is engaged in the professions of legal / medical / engineering / architectural / accountancy / technical consultancy / interior decoration and whose gross receipts does not exceed Rs. 50,00,000 in the Previous Year.

The presumptive income would be an amount equal to 50% of the total gross receipts or such higher sum as may be declared by the assessee shall be deemed as income under the head Profit and Gains of Business and Profession (PGBP).

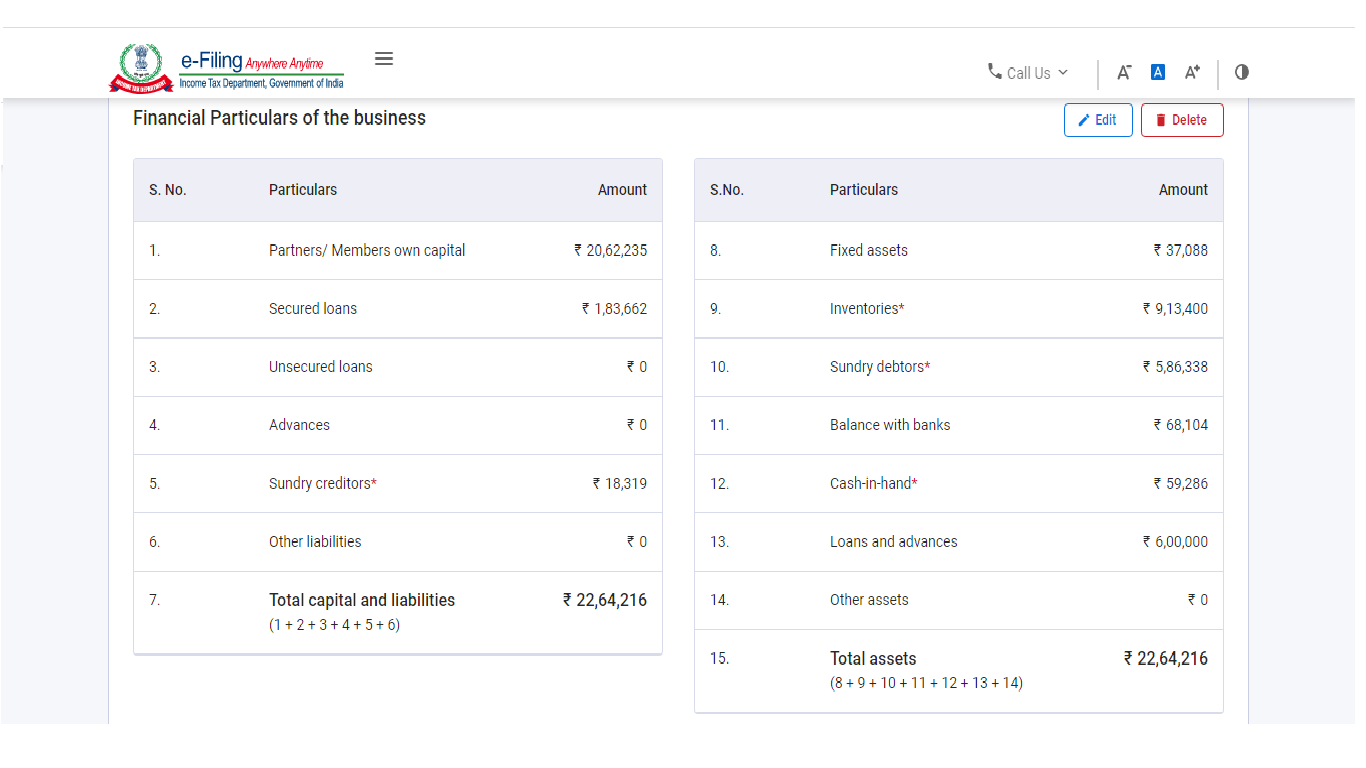

What needs to be disclosed in financial statements in ITR-4

In ITR-4 return, assessee needs to disclose in financial statements the information available as on 31 march of year. It is also mandatory to disclose details of inventories, Debtors, Cash in hand and Creditors. However, the assessee can also disclose full details of the financial statement. Failure to disclose financial information will create problems while ITR processes by assessing officers. What is other information in financial statements can be answered by following-

Liability:

liabilities are obligations of business to pay in future time periods. Liability can be divided into current liabilities and non-current liabilities. Current liabilities are obligations that are scheduled to be paid over the next 12 months. Liability other than current liability is non current liability in statement of financial position report

(1) Partners/Members own capital:- Partners/Members capital represent the money invested by the owner/partner in business. In the end of year, profit from business will also be a part of capital. Capital can also be calculated by total assets minus total liability. As the owner of a business invests money into business it is a liability of business to repay such capital so therefore it is a liability for business.

(2) Secured Loans:- It refers to the loan taken by a business on the guarantee of any assets. For example if a business takes a loan on the security of any land of business then this is a secured loan.

(3) Unsecured Loans:- Loan which is taken without any guarantee.

(4) Advances:- It means any amount received from customers for providing service or supplying goods in the future time period. Amount which is received from customers but no goods or services provided against such amount then this is considered as advance for business.

(5) Sundry creditors:- creditors are those persons who have supplied material or services to business but not received payment against such supplies. In other words these are the suppliers of business. It is the obligations of business to pay money to the supplier that will become due in the current period (within a year). It also includes trade due to vendors and suppliers.

(6) Other Liabilities:- Other liability include those amounts which are not covered in the above category of liability.

Assets:

An asset is a resource that a business holds with the expectation that it will provide future benefit to the business. Business assets can be divided into current assets and noncurrent assets. Assets that will be converted to cash within 12 months are considered current assets. Assets other than current assets are non current assets in the statement of the financial position report.

(1) Fixed Assets:- Fixed assets are items that are physically present in business and owned by the business for a long term. Fixed assets are fixed in nature for example furniture and machinery installed in business premises. These assets provide benefits in future periods.

(2) Inventories:- Inventory is the items that a business purchases from suppliers and sells to the customers. At the end of the year if any stock is available then require to disclose in ITR return. Inventory also includes raw materials, work-in-progress, and finished goods held by business.

(3) Sundry debtors:- Debtors are those persons to whom goods or services provided by payment are not received against such supplies. These receivables are created from the time when goods supply to the customer but not received payment from the customer during the year. Total amount of debtors will be disclosed in ITR form at the end of year.

(4) Balance with bank:- Bank balance is the amount held in a bank account by business at the end of year.

(5) Cash in hand:- Current assets are those which can be liquidated within a short period of time. Cash is the most liquid form of assets used by business for day to day small transactions and it includes money held in cash form. A business also require to disclose in ITR return the detail of cash available at the end of the year

(6) Loans & Advances:- Advance represents money paid by business to the supplier but goods or services are not received against such advance during the year.

(7) Other Assets:- Other assets include those amounts which are not covered in the above category of assets.

Format of Financial Statement of ITR-4

|

Liability |

|

Assets |

|

|

Particulars |

Amount |

Particulars |

Amount |

|

Partners/Members own capital |

|

Fixed Assets |

|

|

Secured Loans |

|

Inventories |

|

|

Unsecured Loans |

|

Sundry debtors |

|

|

Advances |

|

Balance with bank |

|

|

Sundry creditors |

|

Cash in hand |

|

|

Other Liabilities |

|

Loans & Advances |

|

|

|

|

Other Assets |

|

|

Total Liability |

|

Total Assets |

|

How to disclose financial statements for ITR-4

Log in to the e-Filing portal using user ID (As PAN No.) and password to file ITR

Select Assessment Year and ITR-4 Return

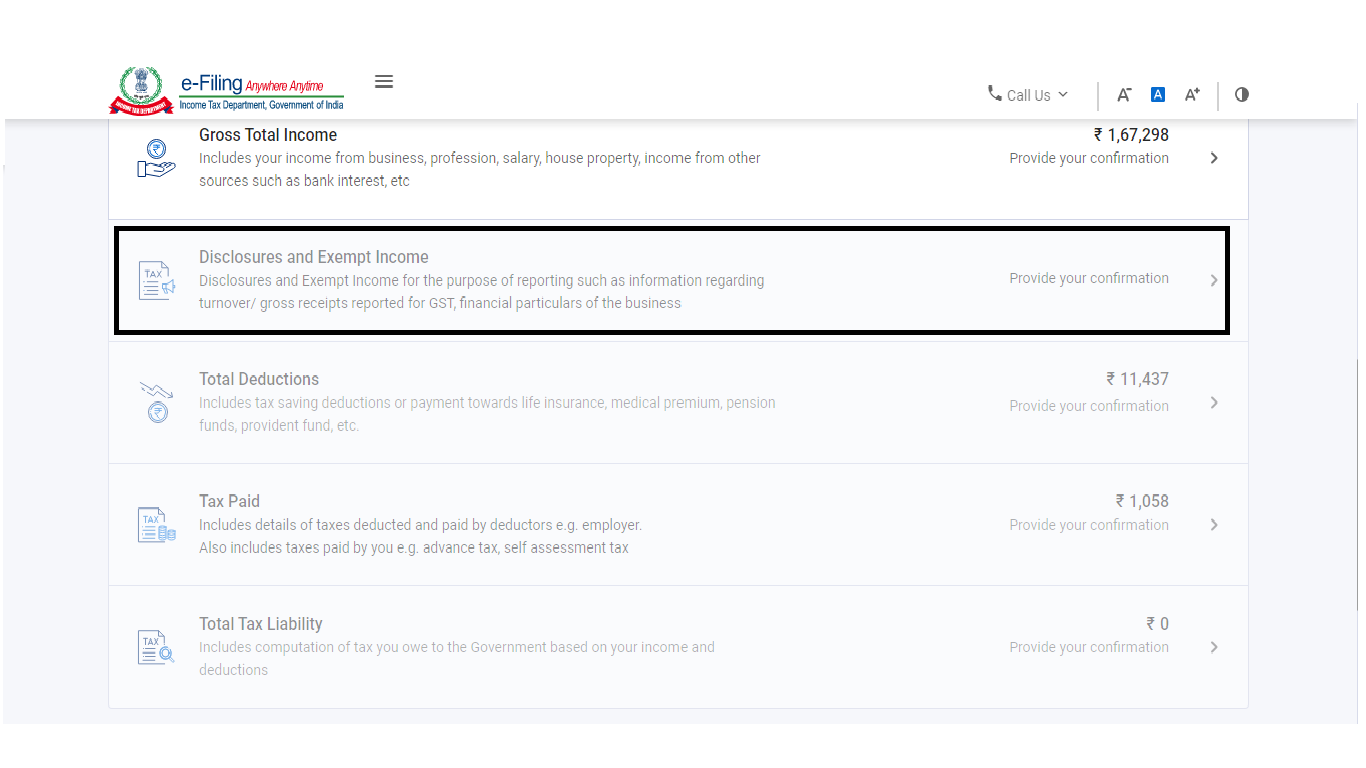

In section of "Disclosures and Exempt Income" , consent to disclose financial information is following:-