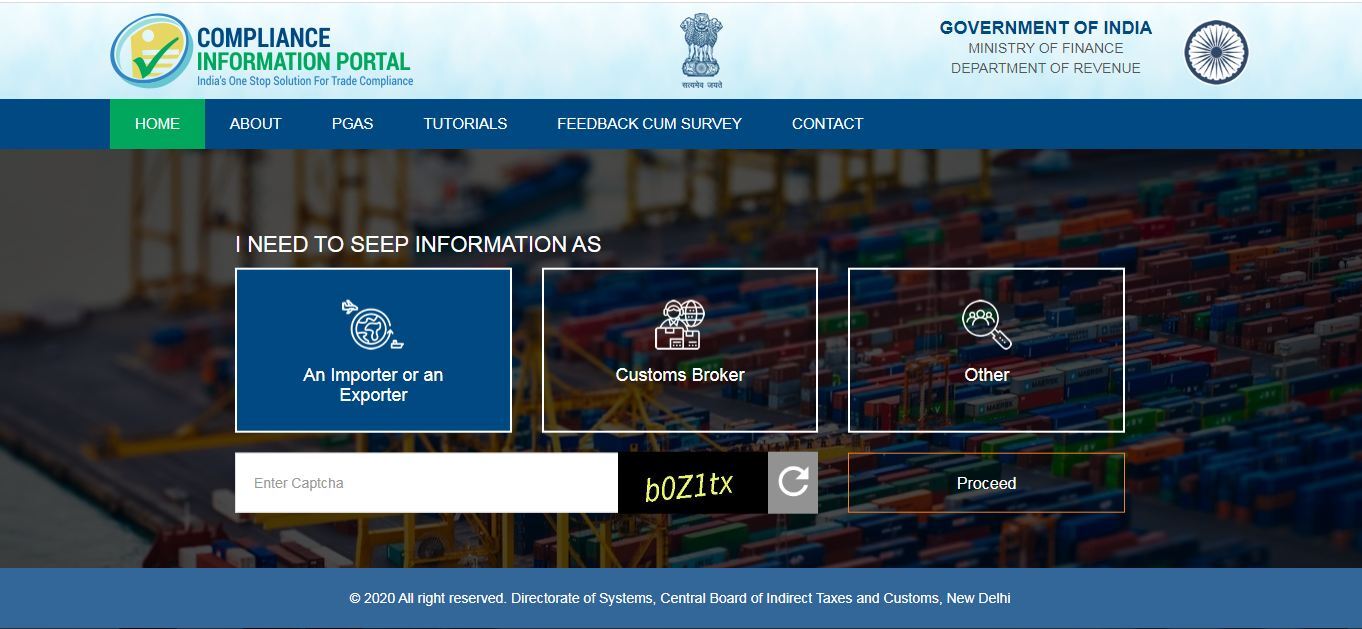

COMPLIANCE INFORMATION PORTAL. (CIP)

Customs21/03/2021 Source:CIP

About CIP-

It provides information related to Laws, step by step Procedures and Acts of Customs and all Partner Government Agencies (PGAs) regulating Import and export of commodities of 10000 plus Tariff Headings on a single portal developed by the Central Board of Indirect Taxes and Customs (CBIC).

Features of CIP:

- Once the user login to CIP the information may be obtained by entering either of the following

- (a) 4 to 8 digit Customs Tariff Heading

- (b) Description of Commodity

- It covers 3 stages of Import and Export

- (a) Prepare for Import and Prepare for Export

- (b) Pre-Import and Pre-Export

- (c) Import and Export

- Provides stage-wise detailed process flow chart for all procedures of export for exporting any commodity covered under the Customs tariff Act, 1975.

- The process flow chart covers all basic steps required from preparing for import to Out of Charge from Customs at Import stage.

- The process flow chart covers all basic steps required from preparing for export to Export General Manifest, when the goods are exported.

- The Process flow chart also provides information about requirement of necessary permissions / clearances or requirement of Licenses/Permits/Certificates/Other Authorizations (LPCOs) to be obtained from any Partner Government Agency (PGA) for imports as well as exports.

- The portal provides weblinks of all Partner Government Agencies whose intervention is required for importing or exporting a commodity at any stage.

- The portal strives to provide every important detail of each step of process flow chart to enable the user to get all necessary information without physically interacting by the Partner Government Agencies. These are :

- (a) Step description

- (b) Requirement description

- (c) Laws/Regulations Governing the step

- (d) Supporting documents required for the step

- (e) Location and Telephone Numbers where the step is carried out

How does the Portal Work:

- The user can search for a commodity on the basis of the following two options:

- If the Chapter Tariff Heading of commodity is known, the user may enter the CTH

- If the user do not know the CTH, search can be made on the basis of description of commodity

Once the user enters the CTH or the description of commodity, the user would be routed to the page where the CTH and its description is available and the user can now select the most relevant option by clicking on it.

- The user is now routed to the page where the Import or Export procedure is to be selected. The user may choose any of the 6 options under Import or 8 options under Export. The options are given below:

- Import Procedures

- Bill of Entry for Home Consumption

Procedure for home consumption on payment of duty. - Bill of Entry for Home Consumption Utilizing Export Benefits

Procedure for clearing goods where duty liability is discharged through export incentive scrips. - Bill of Entry for Home Consumption with Duty Deferment

Procedure for home consumption where goods are cleared with deferred duty payment option. - Bill of Entry for Warehousing

Procedure for warehousing goods after assessment for clearance at any subsequent date on payment of duty. - Ex-Bond Bill of Entry for Home Consumption

Procedure for clearing warehoused goods for home consumption on payment of duty. - Ex-Bond Bill of Entry for Home Consumption Utilizing Export Benefits

Procedure for clearing warehoused goods for home consumption where duty liability is discharged through export incentive scrips. - Export Procedures

- Duty Free Shipping Bill

Procedure meant for exporting goods that do not have export duty liability & without availing any export incentive. - Dutiable Shipping Bill

Procedure meant for exporting goods that have export duty liability & without availing any export incentive. - Shipping Bill Linked with Export Benefits

Procedure meant for exporting goods for availing export incentives. - Shipping Bill under Duty Drawback

Procedure meant for exporting goods for availing Duty Drawback. - Duty Free Shipping Bill with self seal option

Procedure meant for exporting goods that do not have export duty liability & without availing any export incentive with self seal option. - Dutiable Shipping Bill with self seal option

Procedure meant for exporting goods that have export duty liability & without availing any export incentive with self seal option. - Shipping Bill Linked with Export Benefits with self seal option

Procedure meant for exporting goods for availing export incentives with self seal option. - Shipping Bill under Duty Drawback with self seal option

Procedure meant for exporting goods for availing Duty Drawback with self seal option. - On selecting the procedure, the user is then routed to the next page which provides stage-wise step by step information for importing / exporting a commodity. The steps have been divided into 3 following stages :

- Prepare for Import/Export Stage - Steps required to start preparation for Import/ Export

- Pre-Import/Export Stage - Once the steps at prepare stage have been complied with, the user is required to comply with the steps given in this stage.

- Import/Export Stage - Once the above two steps are complete, the user is now ready to import / export the desired commodity. This stage provides steps to the user for completing import / export of the commodity for which the information has been sought.