Revocation of Cancelled Registration

Step for revocation of cancelled registration done by the Tax Official.

A registered person whose registration is cancelled by the proper officer on his own motion may apply to such officer for revocation of cancelled registration within thirty days from the date of service of the cancellation order.

To apply for revocation of cancelled registration by Tax Official, perform the following steps:

1. Access the https://www.gst.gov.in/ URL. The GST Home page is displayed. Login to the GST Portal using earlier login credentials (i.e. credentials using which taxpayer were logging into the GST Portal earlier).

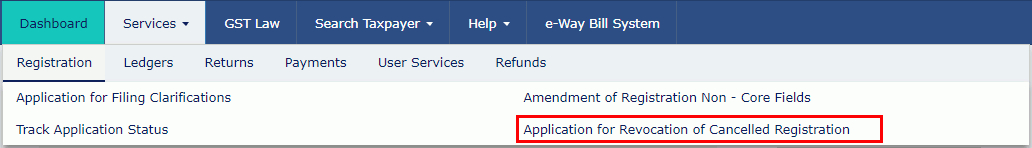

2. Click Services > Registration > Application for Revocation of Cancelled Registration option.

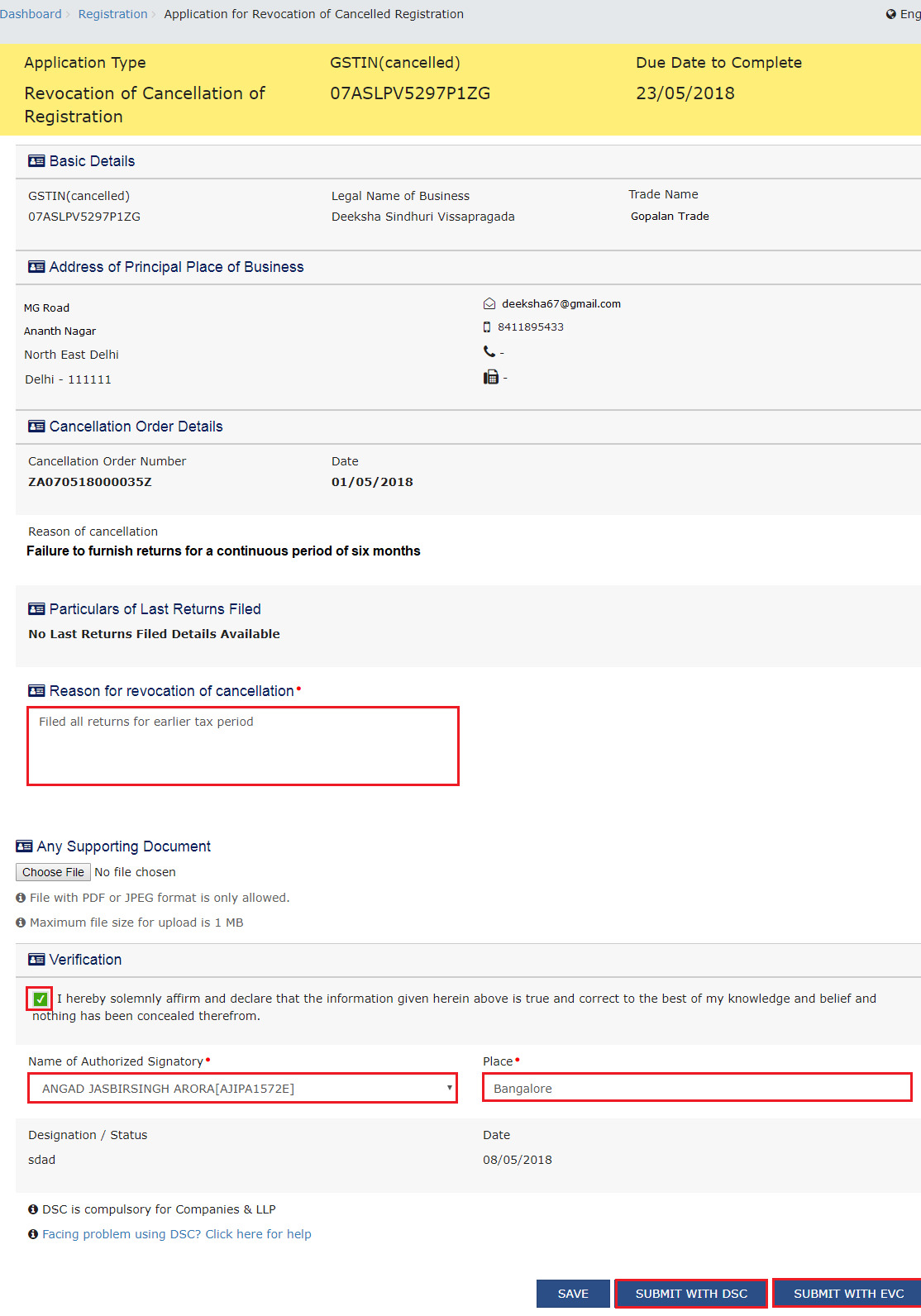

3. In the Reason for revocation of cancellation field, enter the reason for revocation of cancelled registration.

4. Click the Choose File button to attach any supporting document.

5. Select the Verification checkbox.

6. In the Name of Authorized Signatory drop-down list, select the name of authorized signatory.

7. In the Place field, enter the place where the application is filed.

Note: You can click the SAVE button to save the application form and retrieve it later.

8. Click the SUBMIT WITH DSC or SUBMIT WITH EVC button.

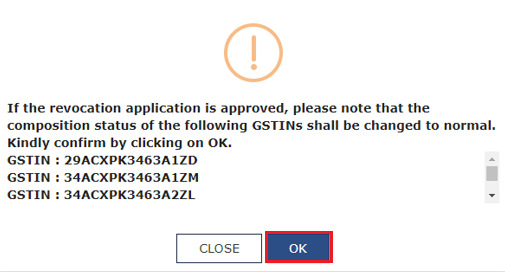

Note: If the application for revocation of cancelled registration is approved for GSTIN registered as a Regular and SEZ unit/SEZ Developer/ISD/E-commerce/Interstate supplies/TDS/TCS/NRTP/Casual Taxable Person, GSTINs which are registered as Composition with same PAN will be changed to normal.

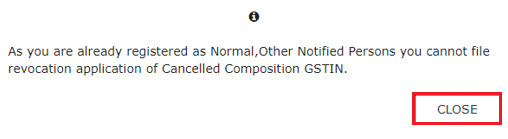

Note: You cannot file for revocation application of cancelled composition GSTIN, in case, you are already registered as a Regular and SEZ unit/SEZ Developer/ISD/E-commerce/Interstate supplies/TDS/TCS/NRTP/Casual Taxable Person or other notified persons.

In case of SUBMIT WITH DSC:

9.(A) Click the PROCEED button.

In case of SUBMIT WITH EVC:

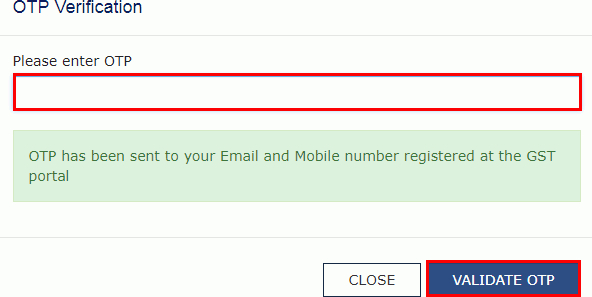

9.(B) Enter the OTP sent to email address of the Authorized Signatory registered at the GST Portal and click the VALIDATE OTP button.

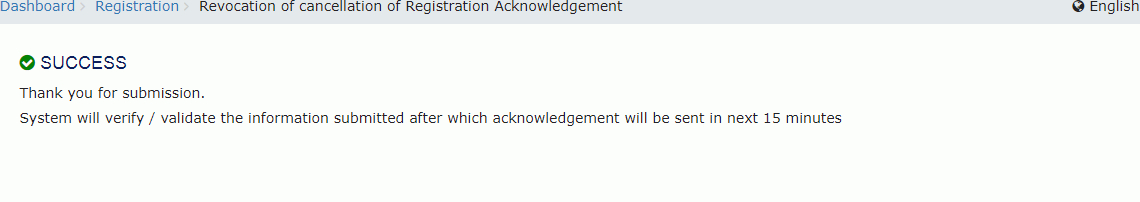

The success message is displayed. You will receive the acknowledgement in next 15 minutes on your registered e-mail address and mobile phone number. Application Reference Number (ARN) receipt is sent on your e-mail address and mobile phone number.