What is the use of New Quarterly GSTR-2B Statement available on GST portal?

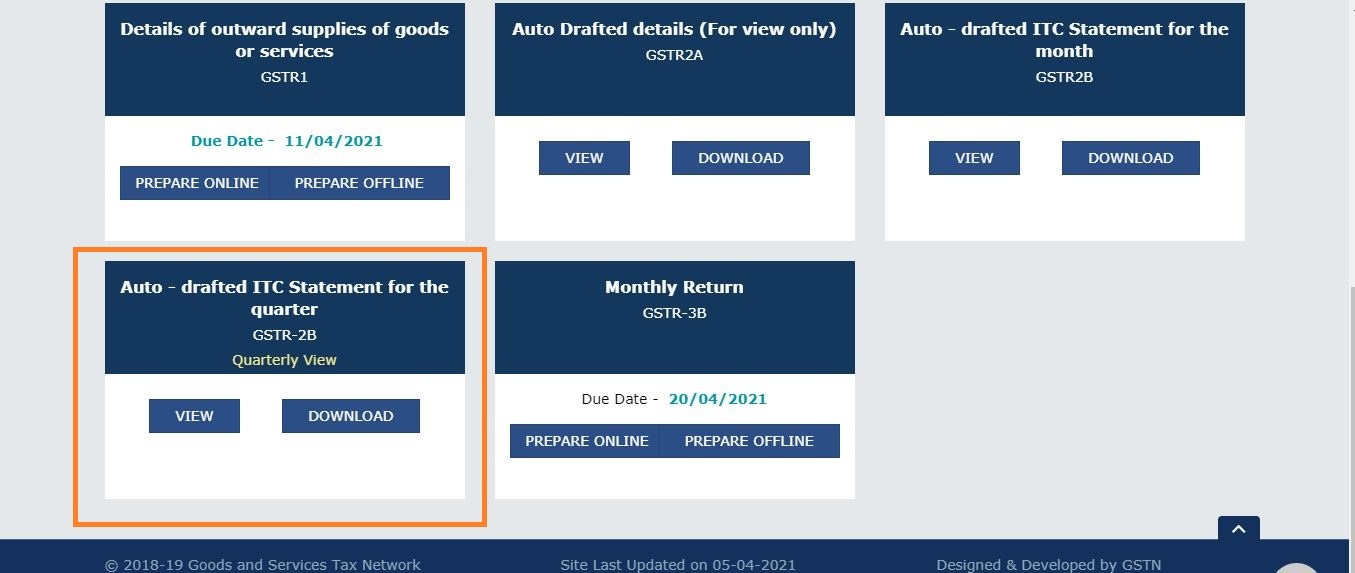

New Quarterly GSTR-2B Statement is available on GST portal for January-March 2021 tax period effective from 1-4-2021.

Details of ITC will be auto populate from 13th of April 2021 (Last cutoff date).

In the case, where taxpayers opt to file GSTR-3B on quarterly basis than In first two months of the quarter, no declaration pertaining to ITC is required to be made. The available ITC for the entire quarter will be made available by the system in quarterly FORM GSTR-2B. This quarterly facility will be in addition to the FORM GSTR-2B being made available on a monthly basis, which can still be used for doing self-assessment.

Taxpayers will be provided with a draft GSTR-3B, which will contain the details of the liability to be paid by taxpayers in the quarterly GSTR-3B. This will be prepared on the basis of the supplies declared in FORM GSTR-1 for the quarter. It will also contain data from the optional IFF, if any is filed in either of the first two months of the quarter. The said system computed values will also be auto populated in quarterly GSTR-3B.